引言

动量效应是金融市场中一种重要的现象,指过去表现较好的资产在未来短期内往往继续表现

较好,而过去表现较差的资产则继续表现较差。基于动量效应的交易策略已经被广泛研究和

应用。

在股票市场中,大盘股和小盘股通常具有不同的风险收益特征和市场表现。本研究旨在探索

一种基于动量的轮动策略,通过比较大盘股和小盘股的相对强度,动态调整投资组合的配置,

以获取超额收益。

我们将使用R语言实现这一策略,并通过历史数据验证其有效性。同时,我们会优化策略参数,

测试参数敏感性,并在样本外数据上验证策略的稳健性。

数据准备与分析

首先加载必要的R包并获取股票数据。我们将选取多只大盘股和小盘股作为研究对象。

# 加载必要的R包

library(quantmod)

library(PerformanceAnalytics)

library(foreach)

library(doParallel)

library(ggplot2)

library(dplyr)

library(tidyr)

library(caret)

library(magrittr)

接下来,我们获取股票数据。我们将选择10只大盘股和10只小盘股作为样本。大盘股选取标

普500指数成分股中市值最大的10只,小盘股选取罗素2000指数成分股中市值最小的10只。

# 设置起止日期

start_date <- "2018-01-01"

end_date <- "2023-01-01"

out_of_sample_date <- "2023-01-02"

end_oos_date <- "2023-12-31"

# 大盘股列表

large_cap_symbols <- c("AAPL", "MSFT", "AMZN", "TSLA")

# 小盘股列表

small_cap_symbols <- c("ARQT", "AVXL", "BPMC", "CELZ")

# 所有股票代码

all_symbols <- c(large_cap_symbols, small_cap_symbols)

# 获取股票数据

stock_data <- list()

for (symbol in all_symbols) {

tryCatch(

{

stock_data_raw <- getSymbols(symbol,

from = start_date,

to = end_date,

auto.assign = FALSE)

colnames(stock_data_raw) <- c("Open",

"High",

"Low",

"Close",

"Volume",

"Adjusted")

stock_data[[symbol]] <- stock_data_raw

cat("Successfully downloaded", symbol, "\n")

},

error = function(e) {

cat("Error downloading", symbol, ":", conditionMessage(e), "\n")

}

)

}

## Successfully downloaded AAPL

## Successfully downloaded MSFT

## Successfully downloaded AMZN

## Successfully downloaded TSLA

## Successfully downloaded ARQT

## Successfully downloaded AVXL

## Successfully downloaded BPMC

## Successfully downloaded CELZ

# 过滤掉下载失败的股票

valid_symbols <- names(stock_data)

large_cap_symbols <- large_cap_symbols[large_cap_symbols %in% valid_symbols]

small_cap_symbols <- small_cap_symbols[small_cap_symbols %in% valid_symbols]

# 获取样本外数据

oos_data <- list()

for (symbol in valid_symbols) {

tryCatch(

{

oss_data_raw <- getSymbols(symbol,

from = out_of_sample_date,

to = end_oos_date,

auto.assign = FALSE)

colnames(oss_data_raw) <- c("Open",

"High",

"Low",

"Close",

"Volume",

"Adjusted")

oos_data[[symbol]] <- oss_data_raw

cat("Successfully downloaded OOS data for", symbol, "\n")

},

error = function(e) {

cat("Error downloading OOS data for", symbol, ":", conditionMessage(e), "\n")

}

)

}

## Successfully downloaded OOS data for AAPL

## Successfully downloaded OOS data for MSFT

## Successfully downloaded OOS data for AMZN

## Successfully downloaded OOS data for TSLA

## Successfully downloaded OOS data for ARQT

## Successfully downloaded OOS data for AVXL

## Successfully downloaded OOS data for BPMC

## Successfully downloaded OOS data for CELZ

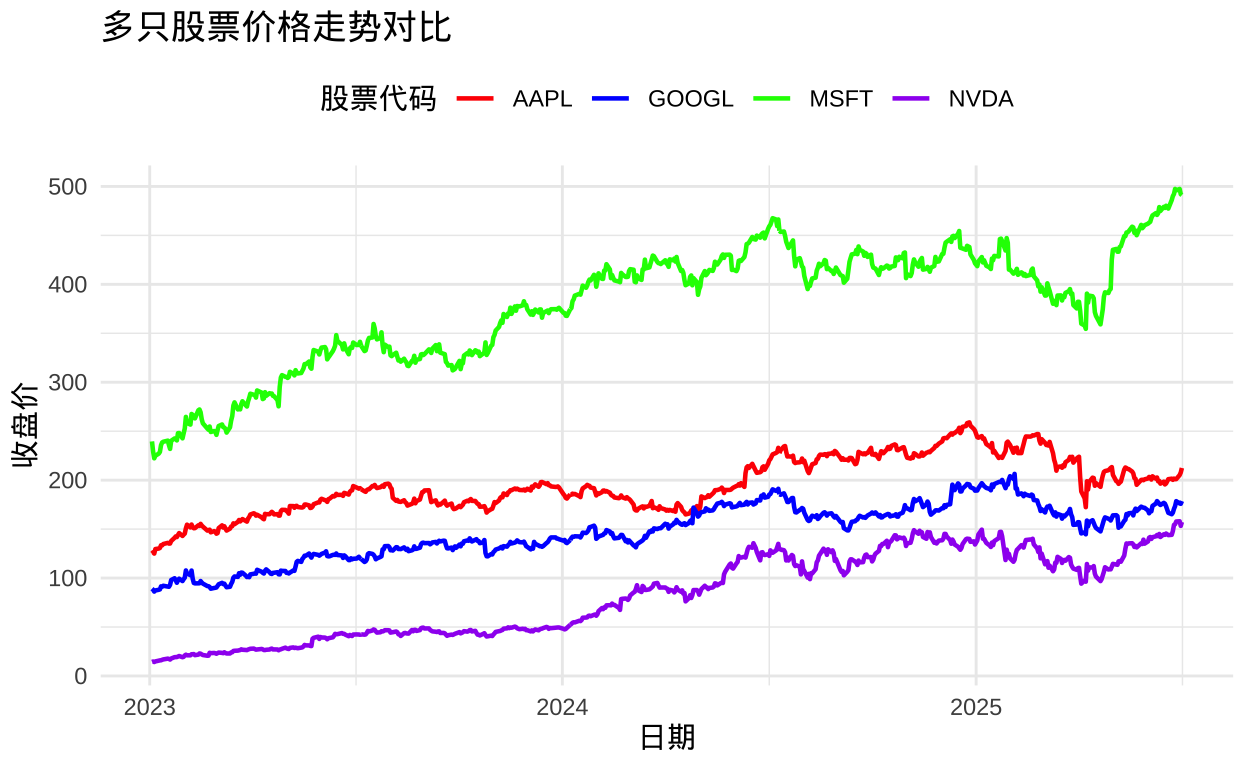

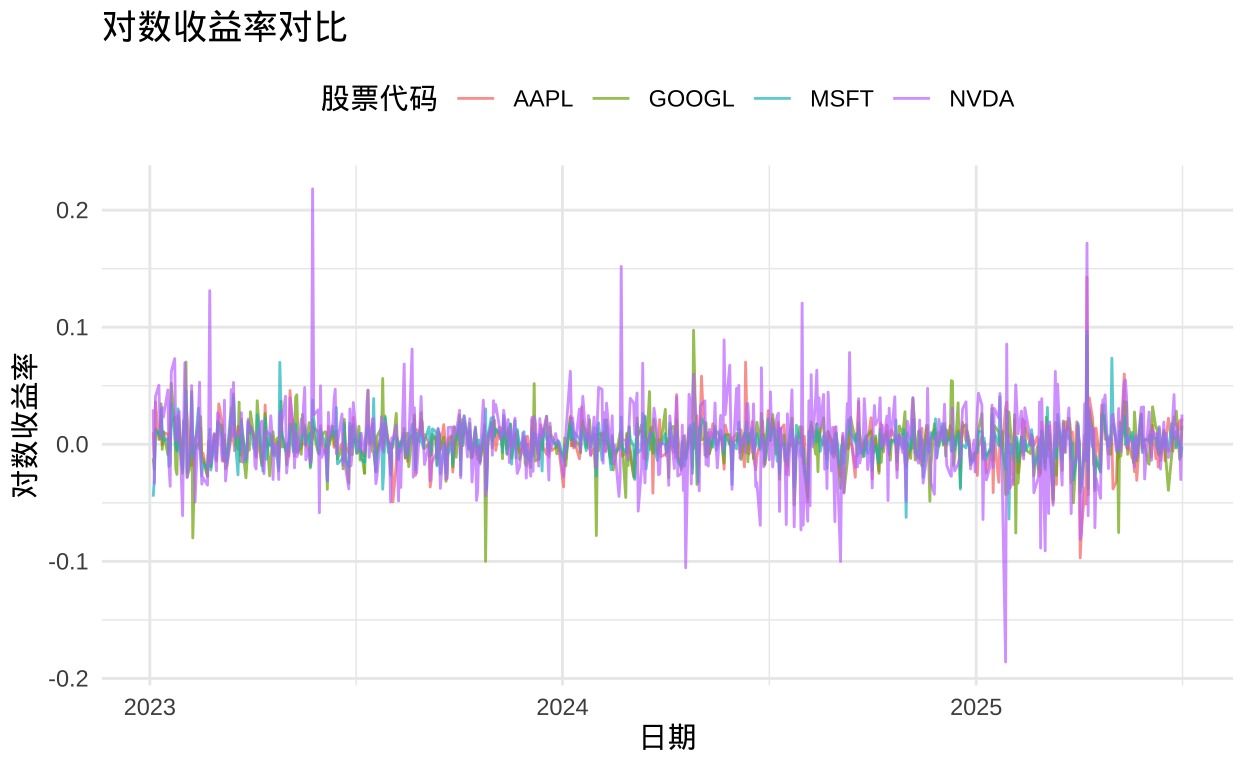

让我们计算并可视化大盘股和小盘股的平均价格走势,以便对数据有一个直观的了解。