R语言与多股票波动性及相关性的可视化

前言

在量化投资建模过程之前,有时候,我们需要对多只股票的价格走势、收益率序列、波动率等进行分析。下面给出使用 R 语言比较多只股票价格走势的完整解决方案。方案涵盖数据获取、清洗、可视化及基础分析全流程:

数据获取

安装与加载工具包

# 安装必要包(首次运行需取消注释)

# install.packages(c("quantmod",

# "tidyverse",

# "ggplot2",

# "zoo",

# "corrplot"))

library(quantmod) # 获取金融数据

library(tidyverse) # 数据处理

library(ggplot2) # 可视化

library(zoo) # 时间序列处理

定义股票代码与时间范围

# 股票代码列表(支持多市场,如A股需加 .SS/.SZ)

# 苹果、谷歌、微软、英伟达

stocks <- c("AAPL", "GOOGL", "MSFT", "NVDA")

# 时间范围

start_date <- "2023-01-01"

end_date <- Sys.Date() # 获取当前日期

批量获取股票数据

# 获取数据

getSymbols(stocks,

src = "yahoo",

from = start_date,

to = end_date)

## [1] "AAPL" "GOOGL" "MSFT" "NVDA"

# 处理数据

stock_data <- lapply(stocks, function(x) {

data <- as_tibble(get(x)) %>%

mutate(Date = index(get(x))) %>%

rename_with(~ gsub(paste0("^", x, "\\."), "", .x)) %>%

select(Date, Close) %>%

mutate(symbol = x) %>% # 添加股票代码列

rename(price = Close) # 重命名收盘价列

}) %>%

bind_rows()

# 查看结果

head(stock_data)

## # A tibble: 6 × 3

## Date price symbol

## <date> <dbl> <chr>

## 1 2023-01-03 125. AAPL

## 2 2023-01-04 126. AAPL

## 3 2023-01-05 125. AAPL

## 4 2023-01-06 130. AAPL

## 5 2023-01-09 130. AAPL

## 6 2023-01-10 131. AAPL

数据清洗

处理缺失值

library(dplyr)

# 检查缺失值

missing_values <- stock_data %>%

group_by(symbol) %>%

summarise(missing = sum(is.na(price)))

# 填充缺失值(使用前向填充)

stock_data <- stock_data %>%

group_by(symbol) %>%

mutate(price = na.locf(price))

对齐时间序列

library(dplyr)

# 生成完整日期序列

full_dates <- tibble(Date = seq(as.Date(start_date),

as.Date(end_date),

by = "day"))

# 左连接填充所有日期

stock_data <- full_dates %>%

left_join(stock_data, by = "Date") %>%

group_by(symbol) %>%

fill(price, .direction = "downup") %>%

na.omit()

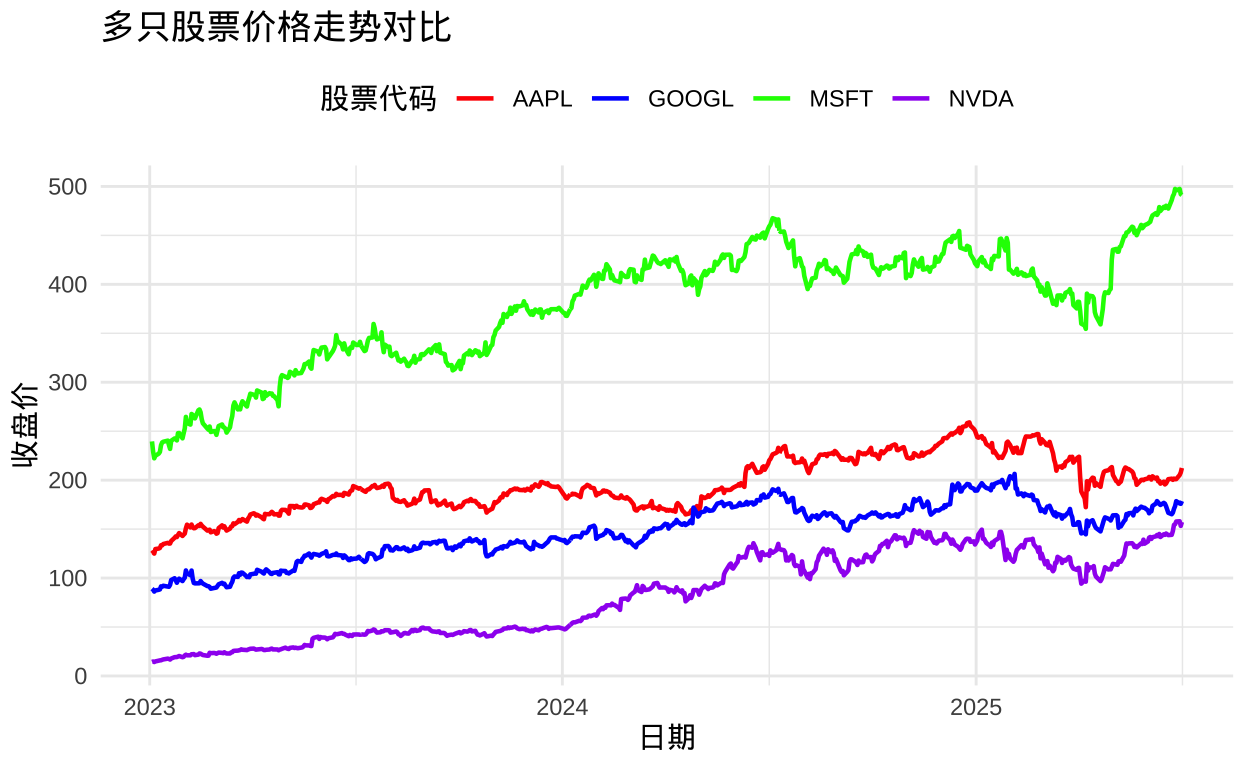

价格走势可视化

基础折线图

library(dplyr)

ggplot(stock_data, aes(x = Date, y = price, color = symbol)) +

geom_line(linewidth = 0.8) +

labs(title = "多只股票价格走势对比",

x = "日期",

y = "收盘价",

color = "股票代码") +

theme_minimal() +

theme(legend.position = "top") +

scale_color_manual(values = c("AAPL" = "red",

"GOOGL" = "blue",

"MSFT" = "green",

"NVDA" = "purple")

)

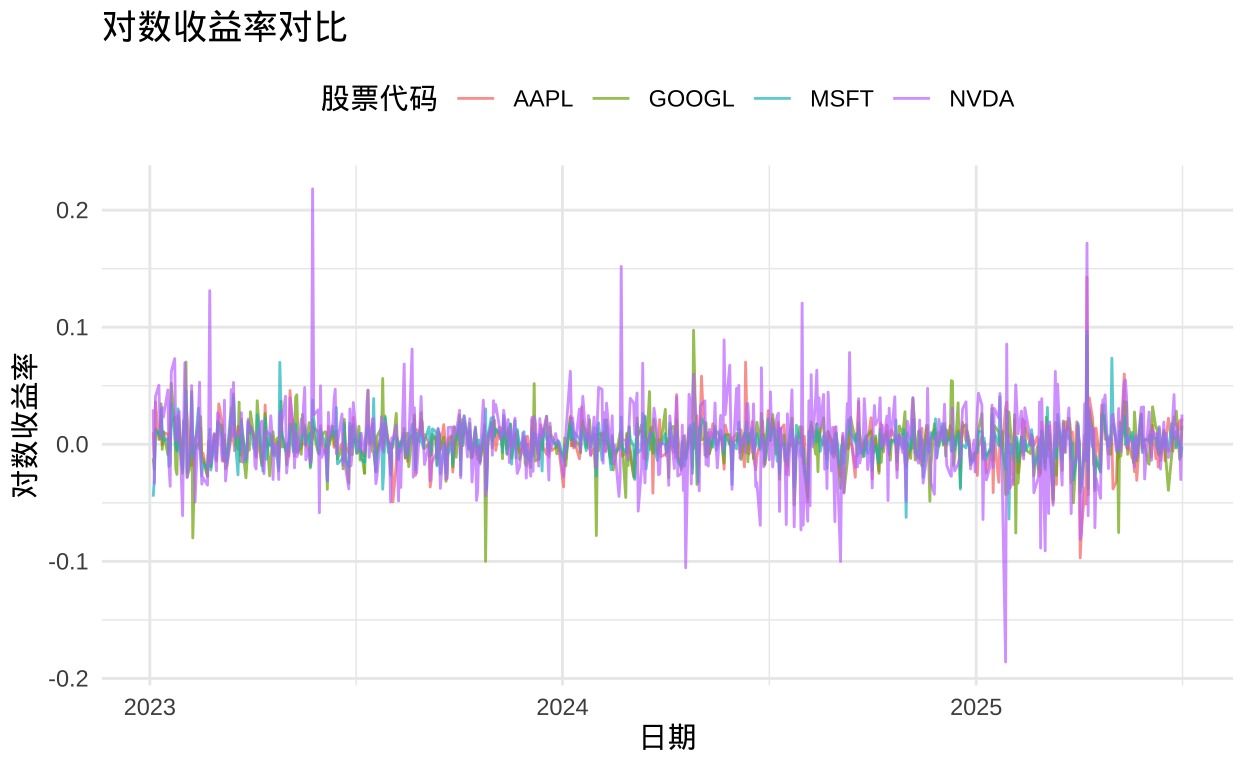

对数收益率对比

library(dplyr)

# 计算对数收益率

return_data <- stock_data %>%

group_by(symbol) %>%

mutate(log_return = log(price) - log(lag(price))) %>%

na.omit()

# 绘制收益率曲线

ggplot(return_data,

aes(x = Date, y = log_return, color = symbol)) +

geom_line(alpha = 0.7) +

labs(title = "对数收益率对比",

x = "日期",

y = "对数收益率",

color = "股票代码") +

theme_minimal() +

theme(legend.position = "top") # 图例放底部

绘制对数收益率密度图: