基于动量轮动策略的有效性分析

引言

动量效应是金融市场中一种重要的现象,指过去表现较好的资产在未来短期内往往继续表现 较好,而过去表现较差的资产则继续表现较差。基于动量效应的交易策略已经被广泛研究和 应用。

在股票市场中,大盘股和小盘股通常具有不同的风险收益特征和市场表现。本研究旨在探索 一种基于动量的轮动策略,通过比较大盘股和小盘股的相对强度,动态调整投资组合的配置, 以获取超额收益。

我们将使用R语言实现这一策略,并通过历史数据验证其有效性。同时,我们会优化策略参数, 测试参数敏感性,并在样本外数据上验证策略的稳健性。

数据准备与分析

首先加载必要的R包并获取股票数据。我们将选取多只大盘股和小盘股作为研究对象。

# 加载必要的R包

library(quantmod)

library(PerformanceAnalytics)

library(foreach)

library(doParallel)

library(ggplot2)

library(dplyr)

library(tidyr)

library(caret)

library(magrittr)

接下来,我们获取股票数据。我们将选择10只大盘股和10只小盘股作为样本。大盘股选取标 普500指数成分股中市值最大的10只,小盘股选取罗素2000指数成分股中市值最小的10只。

# 设置起止日期

start_date <- "2018-01-01"

end_date <- "2023-01-01"

out_of_sample_date <- "2023-01-02"

end_oos_date <- "2023-12-31"

# 大盘股列表

large_cap_symbols <- c("AAPL", "MSFT", "AMZN", "TSLA")

# 小盘股列表

small_cap_symbols <- c("ARQT", "AVXL", "BPMC", "CELZ")

# 所有股票代码

all_symbols <- c(large_cap_symbols, small_cap_symbols)

# 获取股票数据

stock_data <- list()

for (symbol in all_symbols) {

tryCatch(

{

stock_data_raw <- getSymbols(symbol,

from = start_date,

to = end_date,

auto.assign = FALSE)

colnames(stock_data_raw) <- c("Open",

"High",

"Low",

"Close",

"Volume",

"Adjusted")

stock_data[[symbol]] <- stock_data_raw

cat("Successfully downloaded", symbol, "\n")

},

error = function(e) {

cat("Error downloading", symbol, ":", conditionMessage(e), "\n")

}

)

}

## Successfully downloaded AAPL

## Successfully downloaded MSFT

## Successfully downloaded AMZN

## Successfully downloaded TSLA

## Successfully downloaded ARQT

## Successfully downloaded AVXL

## Successfully downloaded BPMC

## Successfully downloaded CELZ

# 过滤掉下载失败的股票

valid_symbols <- names(stock_data)

large_cap_symbols <- large_cap_symbols[large_cap_symbols %in% valid_symbols]

small_cap_symbols <- small_cap_symbols[small_cap_symbols %in% valid_symbols]

# 获取样本外数据

oos_data <- list()

for (symbol in valid_symbols) {

tryCatch(

{

oss_data_raw <- getSymbols(symbol,

from = out_of_sample_date,

to = end_oos_date,

auto.assign = FALSE)

colnames(oss_data_raw) <- c("Open",

"High",

"Low",

"Close",

"Volume",

"Adjusted")

oos_data[[symbol]] <- oss_data_raw

cat("Successfully downloaded OOS data for", symbol, "\n")

},

error = function(e) {

cat("Error downloading OOS data for", symbol, ":", conditionMessage(e), "\n")

}

)

}

## Successfully downloaded OOS data for AAPL

## Successfully downloaded OOS data for MSFT

## Successfully downloaded OOS data for AMZN

## Successfully downloaded OOS data for TSLA

## Successfully downloaded OOS data for ARQT

## Successfully downloaded OOS data for AVXL

## Successfully downloaded OOS data for BPMC

## Successfully downloaded OOS data for CELZ

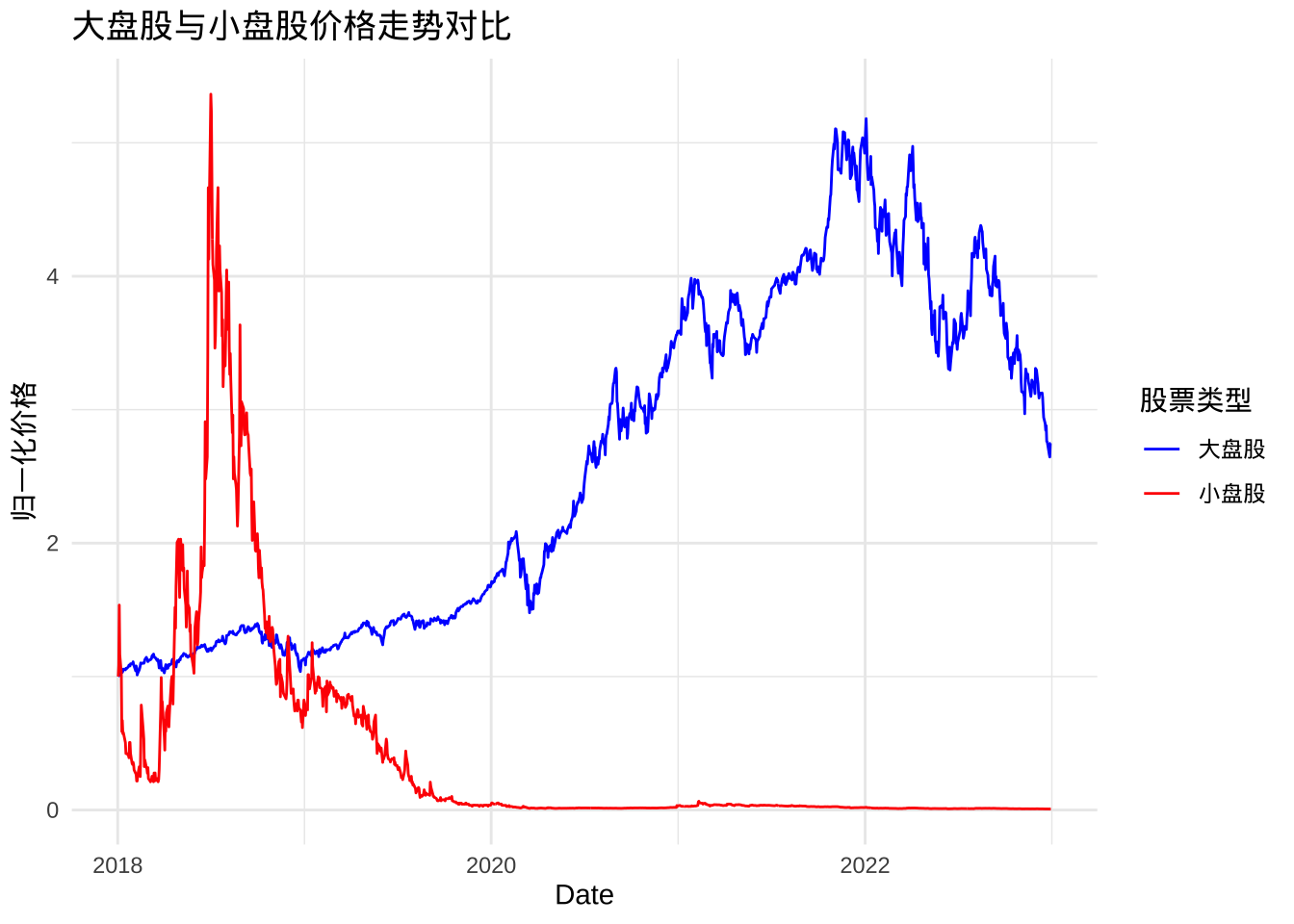

让我们计算并可视化大盘股和小盘股的平均价格走势,以便对数据有一个直观的了解。

# 函数:合并多只股票的收盘价并处理缺失值

merge_stock_prices <- function(symbols, stock_data_list) {

merged_prices <- NULL

for (symbol in symbols) {

# 提取单只股票的收盘价

stock_close <- Cl(stock_data_list[[symbol]])

# 如果是第一只股票,直接赋值

if (is.null(merged_prices)) {

merged_prices <- stock_close

colnames(merged_prices) <- symbol

} else {

# 合并多只股票,自动对齐日期

merged_prices <- merge(merged_prices, stock_close)

colnames(merged_prices)[ncol(merged_prices)] <- symbol

}

}

# 处理缺失值:使用前向填充和后向填充结合

merged_prices <- na.locf(merged_prices) # 前向填充

merged_prices <- na.locf(merged_prices, fromLast = TRUE) # 后向填充

return(merged_prices)

}

# 合并大盘股和小盘股的价格数据

large_cap_merged <- merge_stock_prices(large_cap_symbols, stock_data)

small_cap_merged <- merge_stock_prices(small_cap_symbols, stock_data)

# 确保两个数据集具有相同的日期范围

common_dates <- intersect(index(large_cap_merged), index(small_cap_merged))

large_cap_merged <- large_cap_merged[common_dates]

small_cap_merged <- small_cap_merged[common_dates]

# 计算平均价格

large_cap_avg <- rowMeans(large_cap_merged)

small_cap_avg <- rowMeans(small_cap_merged)

# 归一化价格

large_cap_norm <- large_cap_avg / large_cap_avg[1]

small_cap_norm <- small_cap_avg / small_cap_avg[1]

# 创建绘图数据框

price_data <- data.frame(

Date = as.Date(index(large_cap_merged)),

Large_Cap = as.numeric(large_cap_norm),

Small_Cap = as.numeric(small_cap_norm)

)

# 使用ggplot2绘制对比图

library(ggplot2)

ggplot(price_data, aes(x = Date)) +

geom_line(aes(y = Large_Cap, color = "大盘股")) +

geom_line(aes(y = Small_Cap, color = "小盘股")) +

labs(

title = "大盘股与小盘股价格走势对比",

y = "归一化价格",

color = "股票类型"

) +

theme_minimal() +

scale_color_manual(values = c("大盘股" = "blue", "小盘股" = "red"))

动量轮动策略实现

下面我们实现基于动量的大盘股/小盘股轮动策略。该策略的核心思想是:比较大盘股和小盘 股的相对动量,选择动量更强的一组进行投资。

首先定义一个函数来实现这个策略:

# 改进的动量轮动策略函数

momentum_rotation_strategy <- function(large_cap_data, small_cap_data,

lookback_period = 20,

holding_period = 10,

rebalance_threshold = 0.05,

commission = 0.001) {

# 函数:计算单只股票的对数收益率

calculate_returns <- function(stock_data) {

colnames(stock_data) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

close_prices <- Cl(stock_data)

returns <- dailyReturn(close_prices, type = "log")

colnames(returns) <- ""

return(returns)

}

# 计算所有股票的收益率

large_cap_returns_list <- lapply(large_cap_data, calculate_returns)

small_cap_returns_list <- lapply(small_cap_data, calculate_returns)

# 合并所有收益率数据,自动对齐日期

large_cap_returns_merged <- do.call(merge, large_cap_returns_list)

small_cap_returns_merged <- do.call(merge, small_cap_returns_list)

# 将所有NA值填充为0

large_cap_returns_merged <- na.fill(large_cap_returns_merged, fill = 0)

small_cap_returns_merged <- na.fill(small_cap_returns_merged, fill = 0)

# 确保两个数据集具有相同的日期范围

common_dates <- intersect(index(large_cap_returns_merged),

index(small_cap_returns_merged))

large_cap_returns_merged <- large_cap_returns_merged[common_dates]

small_cap_returns_merged <- small_cap_returns_merged[common_dates]

# 计算平均收益率(保持xts格式)

large_cap_avg_returns <- xts(rowMeans(large_cap_returns_merged),

order.by = index(large_cap_returns_merged)

)

small_cap_avg_returns <- xts(rowMeans(small_cap_returns_merged),

order.by = index(small_cap_returns_merged)

)

# 计算动量指标(lookback_period天的累计收益率)

large_cap_momentum <- xts(rep(0, length(large_cap_avg_returns)),

order.by = index(large_cap_avg_returns)

)

small_cap_momentum <- xts(rep(0, length(small_cap_avg_returns)),

order.by = index(small_cap_avg_returns)

)

for (i in (lookback_period + 1):length(large_cap_avg_returns)) {

large_cap_momentum[i] <- sum(large_cap_avg_returns[(i - lookback_period):i])

small_cap_momentum[i] <- sum(small_cap_avg_returns[(i - lookback_period):i])

}

# 初始化仓位(保持xts格式)

position <- xts(rep(0, length(large_cap_avg_returns)),

order.by = index(large_cap_avg_returns)

)

position[lookback_period + 1] <- ifelse(large_cap_momentum[lookback_period + 1] > small_cap_momentum[lookback_period + 1], 1, -1)

# 生成交易信号

for (i in (lookback_period + 2):length(large_cap_avg_returns)) {

# 每隔holding_period天重新评估一次

if ((i - lookback_period) %% holding_period == 0) {

# 计算动量差异

momentum_diff <- large_cap_momentum[i] - small_cap_momentum[i]

# 如果动量差异超过阈值,则切换仓位

if (abs(momentum_diff) > rebalance_threshold) {

position[i] <- ifelse(momentum_diff > 0, 1, -1)

} else {

# 否则保持原仓位

position[i] <- position[i - 1]

}

} else {

# 保持原仓位

position[i] <- position[i - 1]

}

}

# 计算策略收益(保持xts格式)

strategy_returns <- position * (large_cap_avg_returns - small_cap_avg_returns)

strategy_return <- na.fill(strategy_returns, fill = 0) # 将NA值填充为0

# 考虑交易成本

# 创建与position相同长度和索引的trades对象

trades <- xts(rep(0, length(position)), order.by = index(position))

trades <- abs(diff(position)) > 0

trades <- na.fill(trades, fill = "FALSE") # 将NA值填充为FALSE

commission_cost <- trades * commission

# 计算净收益(保持xts格式)

net_returns <- strategy_returns - commission_cost

net_returns <- na.fill(net_returns, fill = 0) # 将NA值填充为0

# 计算累积收益(保持xts格式)

cumulative_returns <- exp(cumsum(net_returns)) - 1

# 返回结果(同时包含xts和data.frame格式)

results_xts <- list(

Large_Cap_Returns = large_cap_avg_returns,

Small_Cap_Returns = small_cap_avg_returns,

Strategy_Returns = strategy_returns,

Commission_Cost = commission_cost,

Net_Returns = net_returns,

Cumulative_Returns = cumulative_returns,

Position = position,

Large_Cap_Momentum = large_cap_momentum,

Small_Cap_Momentum = small_cap_momentum

)

results_df <- data.frame(

Date = as.Date(index(large_cap_avg_returns)),

Large_Cap_Momentum = as.numeric(large_cap_momentum),

Small_Cap_Momentum = as.numeric(small_cap_momentum),

Position = as.numeric(position),

Large_Cap_Returns = as.numeric(large_cap_avg_returns),

Small_Cap_Returns = as.numeric(small_cap_avg_returns),

Strategy_Returns = as.numeric(strategy_returns),

Commission_Cost = as.numeric(commission_cost),

Net_Returns = as.numeric(net_returns),

Cumulative_Returns = as.numeric(cumulative_returns)

)

colnames(results_df) <- c(

"Date", "Large_Cap_Momentum", "Small_Cap_Momentum",

"Position", "Large_Cap_Returns", "Small_Cap_Returns",

"Strategy_Returns", "Commission_Cost",

"Net_Returns", "Cumulative_Returns"

)

return(list(df = results_df, xts = results_xts))

}

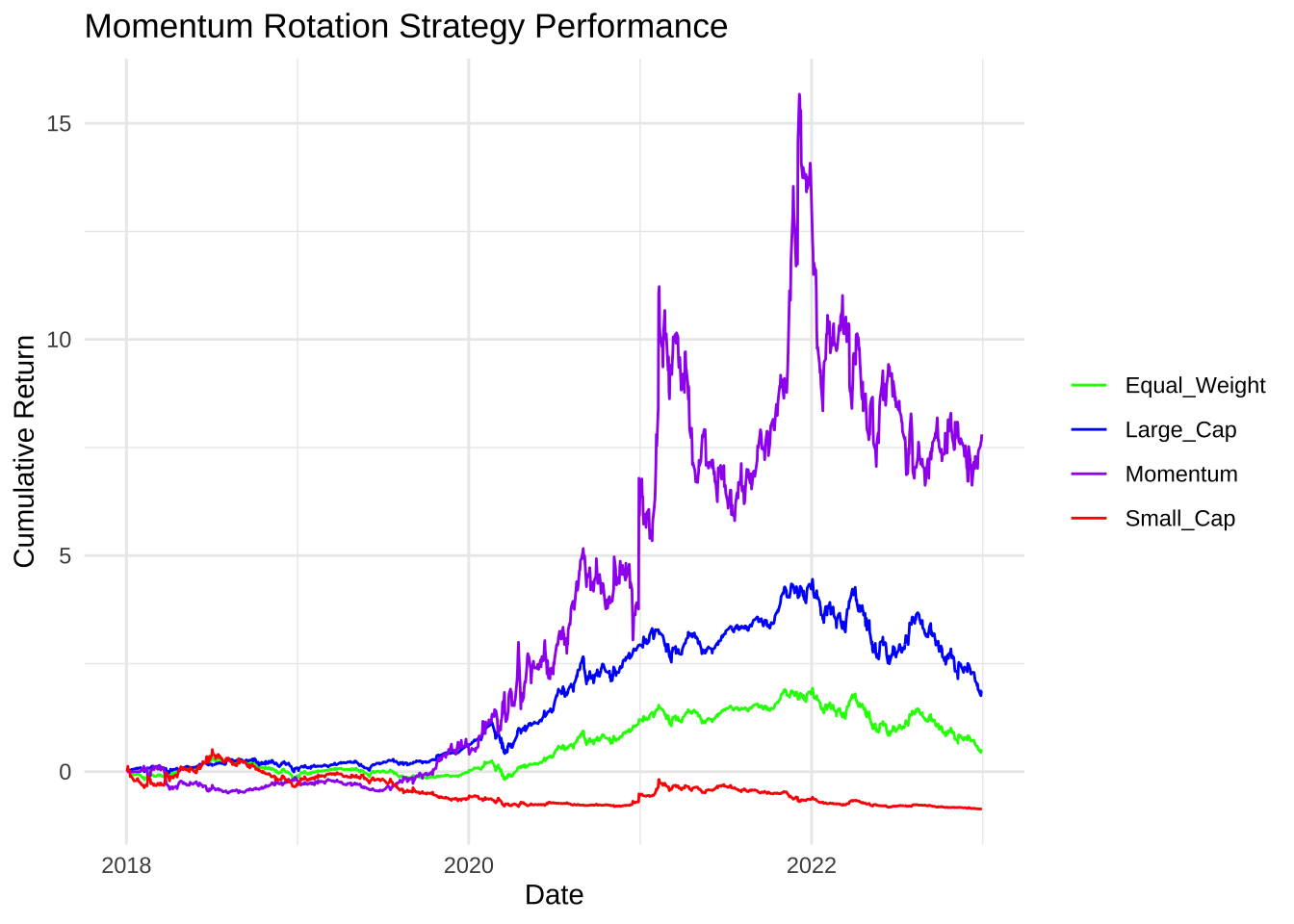

现在我们将这个策略应用到数据上,并评估其表现:

# 应用策略到数据

strategy_results <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(symbol) stock_data[[symbol]]),

lapply(small_cap_symbols, function(symbol) stock_data[[symbol]])

)

# 计算买入持有策略的收益(保持xts格式)

buy_hold_large_cap <- exp(cumsum(strategy_results$xts$Large_Cap_Returns)) - 1

buy_hold_small_cap <- exp(cumsum(strategy_results$xts$Small_Cap_Returns)) - 1

buy_hold_equal <- (buy_hold_large_cap + buy_hold_small_cap) / 2

# 使用ggplot2绘制累积收益对比图

performance_data <- data.frame(

Date = as.Date(index(buy_hold_large_cap)),

Large_Cap = as.numeric(buy_hold_large_cap),

Small_Cap = as.numeric(buy_hold_small_cap),

Equal_Weight = as.numeric(buy_hold_equal),

Momentum = as.numeric(strategy_results$xts$Cumulative_Returns)

)

# 转换为长格式数据以便绘图

library(tidyr)

performance_data_long <- performance_data %>%

pivot_longer(cols = -Date,

names_to = "Strategy",

values_to = "Cumulative_Return")

# 绘制对比图

library(ggplot2)

ggplot(performance_data_long,

aes(x = Date,

y = Cumulative_Return,

color = Strategy)) +

geom_line() +

labs(

title = "Momentum Rotation Strategy Performance",

x = "Date",

y = "Cumulative Return"

) +

scale_color_manual(values = c(

"Large_Cap" = "blue", "Small_Cap" = "red",

"Equal_Weight" = "green", "Momentum" = "purple"

)) +

theme_minimal() +

theme(legend.title = element_blank())

# 计算策略表现指标

library(PerformanceAnalytics)

performance_metrics <- data.frame(

Strategy = c(

"Large Cap Buy & Hold", "Small Cap Buy & Hold",

"Equal Weight Buy & Hold", "Momentum Rotation"

),

Total_Return = c(

buy_hold_large_cap[length(buy_hold_large_cap)],

buy_hold_small_cap[length(buy_hold_small_cap)],

buy_hold_equal[length(buy_hold_equal)],

strategy_results$xts$Cumulative_Returns[length(strategy_results$xts$Cumulative_Returns)]

),

Sharpe_Ratio = c(

SharpeRatio.annualized(strategy_results$xts$Large_Cap_Returns),

SharpeRatio.annualized(strategy_results$xts$Small_Cap_Returns),

SharpeRatio.annualized((strategy_results$xts$Large_Cap_Returns + strategy_results$xts$Small_Cap_Returns) / 2),

SharpeRatio.annualized(strategy_results$xts$Net_Returns)

),

Max_Drawdown = c(

maxDrawdown(strategy_results$xts$Large_Cap_Returns),

maxDrawdown(strategy_results$xts$Small_Cap_Returns),

maxDrawdown((strategy_results$xts$Large_Cap_Returns + strategy_results$xts$Small_Cap_Returns) / 2),

maxDrawdown(strategy_results$xts$Net_Returns)

)

)

# 展示性能指标

print(performance_metrics)

## Strategy Total_Return Sharpe_Ratio Max_Drawdown

## X2022.12.30 Large Cap Buy & Hold 1.8775824 0.4884327 0.5331828

## X2022.12.30.1 Small Cap Buy & Hold -0.8534490 -0.6581043 0.9683605

## X2022.12.30.2 Equal Weight Buy & Hold 0.5120667 -0.3795699 0.7173901

## X2022.12.30.3 Momentum Rotation 7.8035737 0.3099696 0.6298531

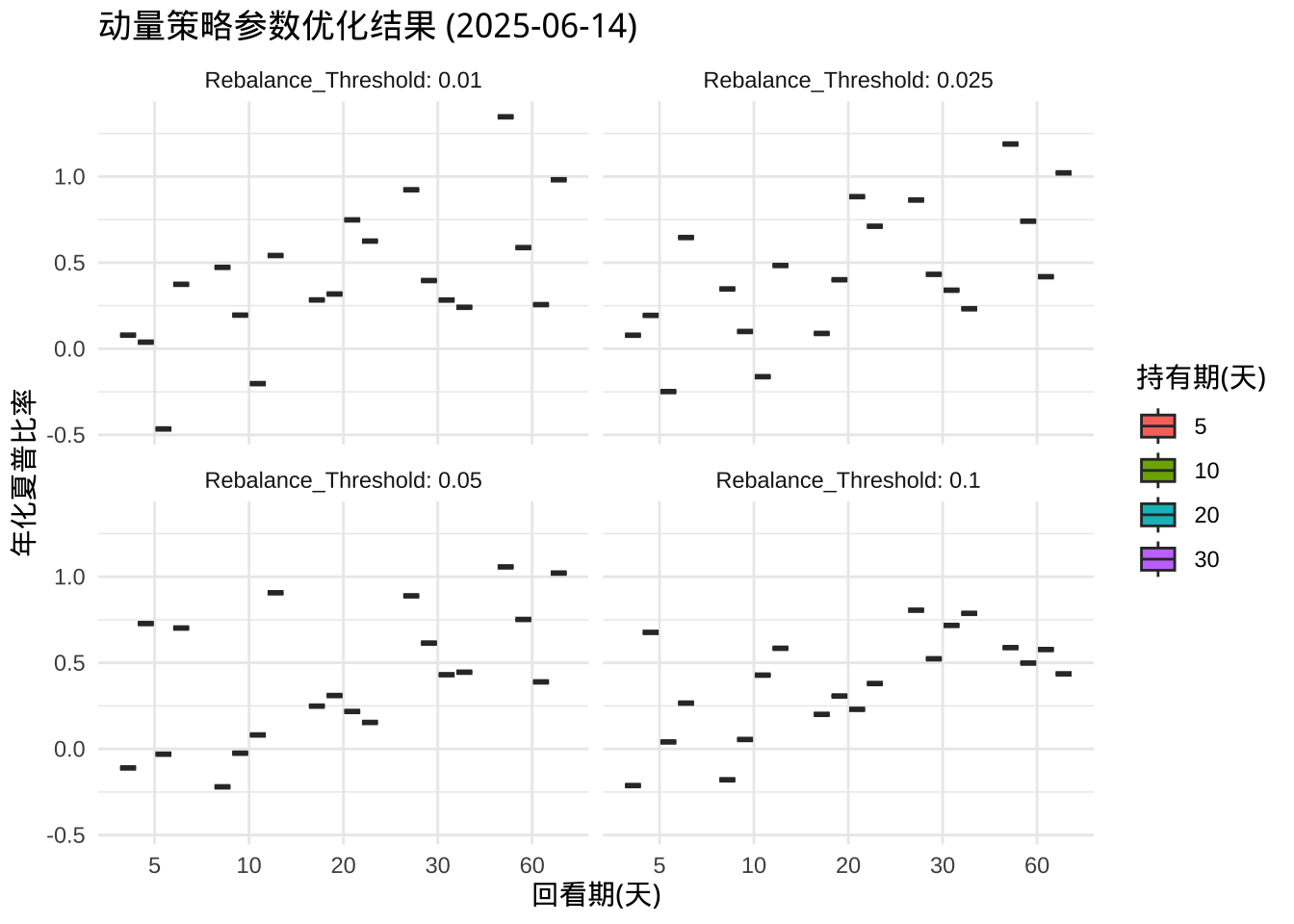

参数优化

接下来,我们将优化动量轮动策略的参数。主要优化的参数是回看期(lookback_period)、 持有期(holding_period)和再平衡阈值(rebalance_threshold)。

我们将使用网格搜索方法来寻找最优参数组合:

# 参数优化主流程

pkg <- c(

"quantmod", "PerformanceAnalytics", "foreach", "doParallel",

"ggplot2", "dplyr", "tidyr", "caret", "magrittr"

)

# 设置参数网格

lookback_periods <- c(5, 10, 20, 30, 60)

holding_periods <- c(5, 10, 20, 30)

rebalance_thresholds <- c(0.01, 0.025, 0.05, 0.1)

# 创建并行集群

cl <- makeCluster(detectCores() - 1)

registerDoParallel(cl)

# 带错误处理的参数优化

optimization_results <- foreach(

lookback = lookback_periods, .combine = rbind,

.packages = pkg, .errorhandling = "pass"

) %:%

foreach(

holding = holding_periods, .combine = rbind,

.packages = pkg

) %:%

foreach(

threshold = rebalance_thresholds, .combine = rbind,

.packages = pkg

) %dopar% {

strategy_result <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(s) stock_data[[s]]),

lapply(small_cap_symbols, function(s) stock_data[[s]]),

lookback, holding, threshold

)

strategy_result_xts <- strategy_result$xts

net_returns <- strategy_result_xts$Net_Returns

sharpe <- as.numeric(SharpeRatio.annualized(net_returns)[1])

data.frame(

Lookback_Period = lookback,

Holding_Period = holding,

Rebalance_Threshold = threshold,

Sharpe_Ratio = sharpe

)

}

stopCluster(cl)

# 结果处理与可视化

optimization_results <- optimization_results[complete.cases(optimization_results), ]

best_params <- optimization_results[which.max(optimization_results$Sharpe_Ratio), ]

print(paste(

"最优参数组合: 回看期=", best_params$Lookback_Period,

" 持有期=", best_params$Holding_Period,

" 阈值=", best_params$Rebalance_Threshold,

" 夏普比率=", round(best_params$Sharpe_Ratio, 3)

))

## [1] "最优参数组合: 回看期= 60 持有期= 5 阈值= 0.01 夏普比率= 1.347"

ggplot(

optimization_results,

aes(

x = factor(Lookback_Period), y = Sharpe_Ratio,

fill = factor(Holding_Period)

)

) +

geom_boxplot() +

facet_wrap(~Rebalance_Threshold, labeller = label_both) +

theme_minimal() +

labs(

title = "动量策略参数优化结果 (2025-06-14)",

x = "回看期(天)",

y = "年化夏普比率",

fill = "持有期(天)"

)

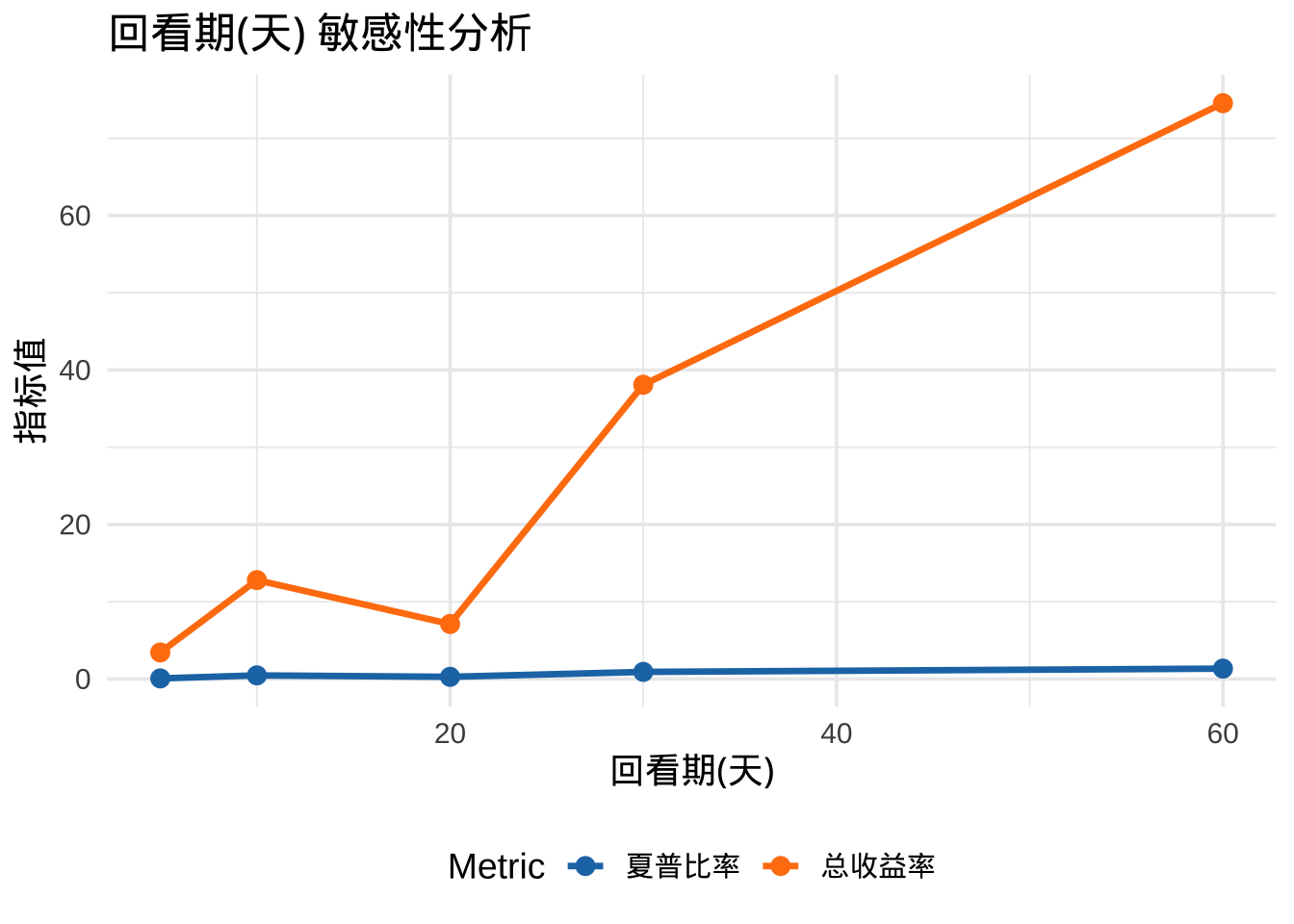

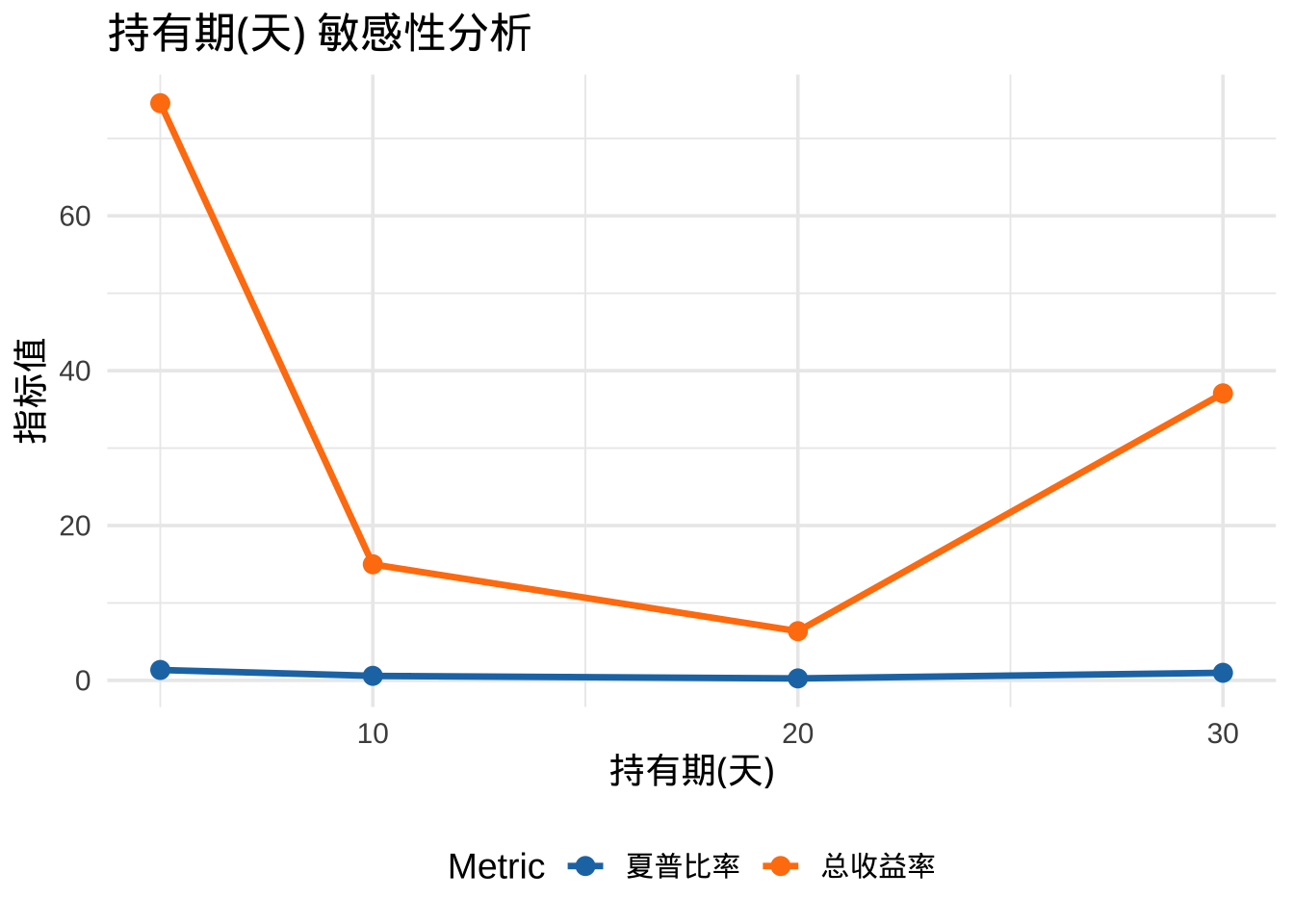

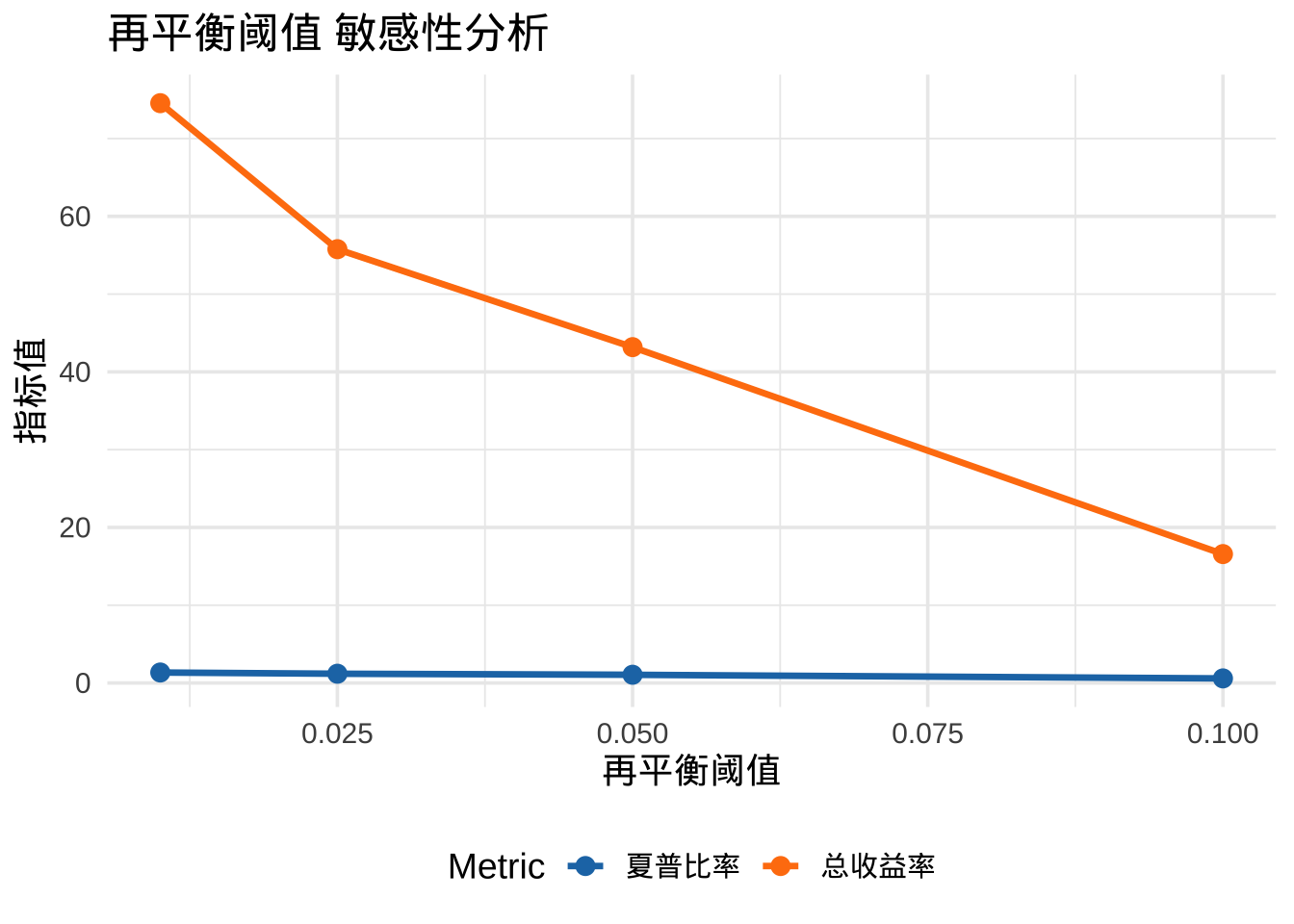

参数敏感性分析

为了进一步了解策略对不同参数的敏感性,我们将进行更详细的参数敏感性分析。

# 1. 回看期敏感性分析

# 创建存储结果的数据框结构

lookback_sensitivity <- data.frame(

Lookback_Period = lookback_periods, # 参数测试序列

Sharpe_Ratio = numeric(length(lookback_periods)), # 夏普比率

Total_Return = numeric(length(lookback_periods)), # 总收益

Max_Drawdown = numeric(length(lookback_periods)) # 最大回撤

)

# 遍历测试不同回看期参数

for (i in seq_along(lookback_periods)) {

result <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(s) stock_data[[s]]), # 大盘股数据

lapply(small_cap_symbols, function(s) stock_data[[s]]), # 小盘股数据

lookback_period = lookback_periods[i], # 当前测试的回看期

holding_period = best_params$Holding_Period, # 固定持有期

rebalance_threshold = best_params$Rebalance_Threshold # 固定阈值

)

# 存储绩效指标

lookback_sensitivity$Sharpe_Ratio[i] <- SharpeRatio.annualized(result$xts$Net_Returns)

lookback_sensitivity$Total_Return[i] <- tail(result$xts$Cumulative_Returns, 1)

lookback_sensitivity$Max_Drawdown[i] <- maxDrawdown(result$xts$Net_Returns)

}

# 2. 持有期敏感性分析(结构同上)

holding_sensitivity <- data.frame(

Holding_Period = holding_periods,

Sharpe_Ratio = numeric(length(holding_periods)),

Total_Return = numeric(length(holding_periods)),

Max_Drawdown = numeric(length(holding_periods))

)

for (i in seq_along(holding_periods)) {

result <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(s) stock_data[[s]]),

lapply(small_cap_symbols, function(s) stock_data[[s]]),

lookback_period = best_params$Lookback_Period,

holding_period = holding_periods[i], # 测试不同持有期

rebalance_threshold = best_params$Rebalance_Threshold

)

holding_sensitivity$Sharpe_Ratio[i] <- SharpeRatio.annualized(result$xts$Net_Returns)

holding_sensitivity$Total_Return[i] <- tail(result$xts$Cumulative_Returns, 1)

holding_sensitivity$Max_Drawdown[i] <- maxDrawdown(result$xts$Net_Returns)

}

# 3. 再平衡阈值敏感性分析

threshold_sensitivity <- data.frame(

Rebalance_Threshold = rebalance_thresholds,

Sharpe_Ratio = numeric(length(rebalance_thresholds)),

Total_Return = numeric(length(rebalance_thresholds)),

Max_Drawdown = numeric(length(rebalance_thresholds))

)

for (i in seq_along(rebalance_thresholds)) {

result <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(s) stock_data[[s]]),

lapply(small_cap_symbols, function(s) stock_data[[s]]),

lookback_period = best_params$Lookback_Period,

holding_period = best_params$Holding_Period,

rebalance_threshold = rebalance_thresholds[i] # 测试不同阈值

)

threshold_sensitivity$Sharpe_Ratio[i] <- SharpeRatio.annualized(result$xts$Net_Returns)

threshold_sensitivity$Total_Return[i] <- tail(result$xts$Cumulative_Returns, 1)

threshold_sensitivity$Max_Drawdown[i] <- maxDrawdown(result$xts$Net_Returns)

}

# 4. 可视化分析结果

plot_sensitivity <- function(data, param_name) {

long_data <- data %>%

pivot_longer(

cols = c(Sharpe_Ratio, Total_Return),

names_to = "Metric", values_to = "Value"

)

ggplot(long_data, aes(

x = .data[[names(data)[1]]], y = Value,

color = Metric, group = Metric

)) +

geom_line(linewidth = 1.2) +

geom_point(size = 3) +

labs(

title = paste(param_name, "敏感性分析"),

x = param_name, y = "指标值"

) +

scale_color_manual(

values = c("Sharpe_Ratio" = "#1f77b4", "Total_Return" = "#ff7f0e"),

labels = c("夏普比率", "总收益率")

) +

theme_minimal(base_size = 14) +

theme(legend.position = "bottom")

}

# 生成三个参数的敏感性图表

plot_sensitivity(lookback_sensitivity, "回看期(天)")

plot_sensitivity(holding_sensitivity, "持有期(天)")

plot_sensitivity(threshold_sensitivity, "再平衡阈值")

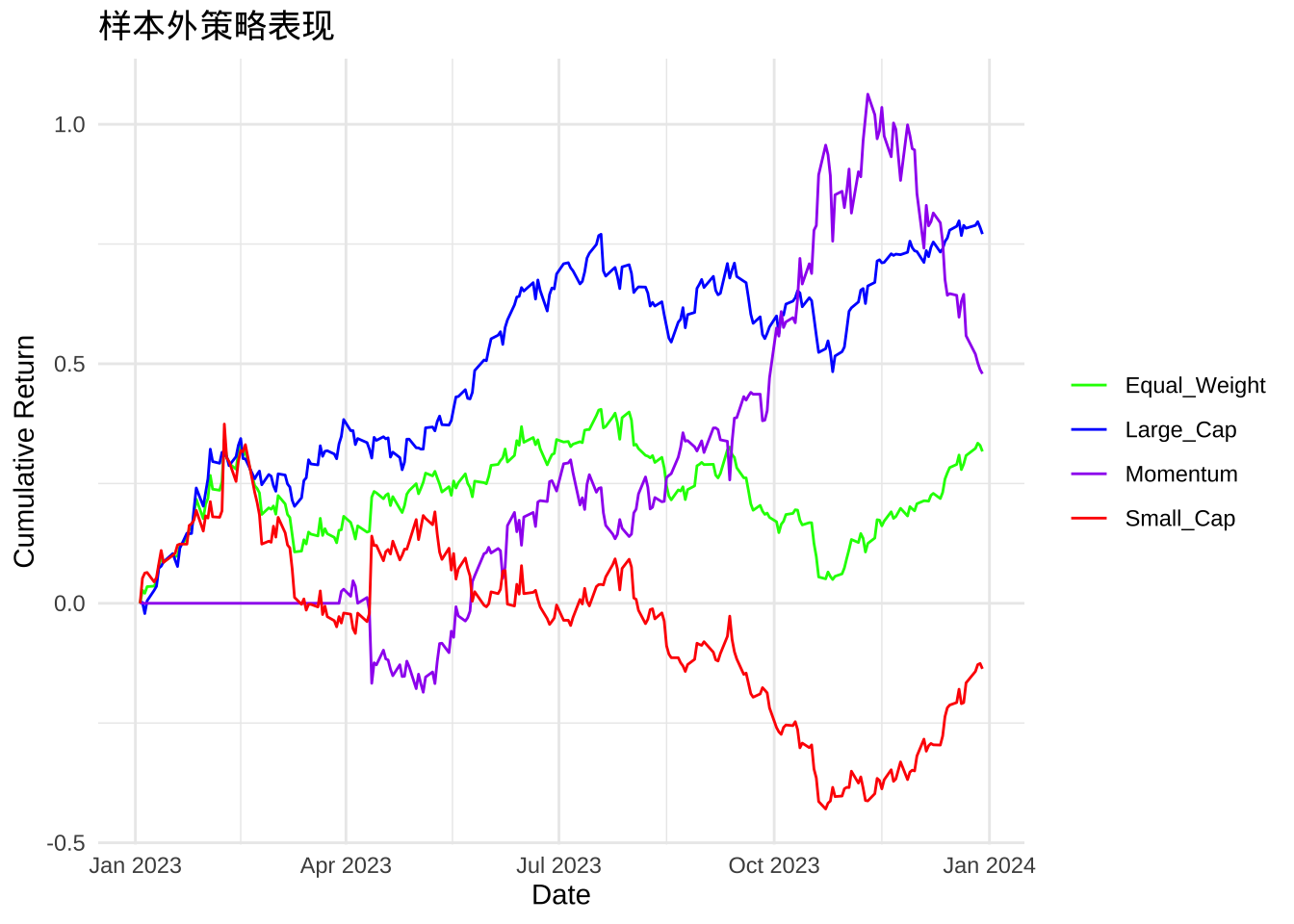

样本外验证

现在我们使用优化后的参数在样本外数据上验证策略的有效性:

# 使用优化后的参数在样本外数据上测试策略

oos_result <- momentum_rotation_strategy(

lapply(large_cap_symbols, function(symbol) oos_data[[symbol]]), # 加载大盘股样本外数据

lapply(small_cap_symbols, function(symbol) oos_data[[symbol]]), # 加载小盘股样本外数据

lookback_period = best_params$Lookback_Period, # 使用优化得到的回看期参数

holding_period = best_params$Holding_Period, # 使用优化得到的持有期参数

rebalance_threshold = best_params$Rebalance_Threshold # 使用优化得到的再平衡阈值

)

# 计算样本外买入持有策略的收益(大盘股)

oos_buy_hold_large_cap <- exp(cumsum(oos_result$xts$Large_Cap_Returns)) - 1 # 累计收益计算

# 计算样本外买入持有策略的收益(小盘股)

oos_buy_hold_small_cap <- exp(cumsum(oos_result$xts$Small_Cap_Returns)) - 1

# 计算等权买入持有策略的收益

oos_buy_hold_equal <- (oos_buy_hold_large_cap + oos_buy_hold_small_cap) / 2

# 准备可视化数据

oos_performance_data <- data.frame(

Date = as.Date(index(oos_result$xts$Large_Cap_Returns)), # 日期序列

Large_Cap = oos_buy_hold_large_cap, # 大盘股买入持有收益

Small_Cap = oos_buy_hold_small_cap, # 小盘股买入持有收益

Equal_Weight = oos_buy_hold_equal, # 等权组合收益

Momentum = oos_result$xts$Cumulative_Returns # 动量策略收益

)

# 转换数据为长格式便于ggplot绘图

oos_performance_data_long <- oos_performance_data %>%

pivot_longer(cols = -Date,

names_to = "Strategy",

values_to = "Cumulative_Return")

# 绘制累积收益对比图

ggplot(oos_performance_data_long,

aes(x = Date,

y = Cumulative_Return, color = Strategy)) +

geom_line() + # 绘制折线图

labs(

title = "样本外策略表现", # 图表标题

x = "Date", y = "Cumulative Return"

) + # 坐标轴标签

scale_color_manual(values = c(

"Large_Cap" = "blue", "Small_Cap" = "red",

"Equal_Weight" = "green", "Momentum" = "purple"

)) + # 颜色设置

theme_minimal() + # 使用简洁主题

theme(legend.title = element_blank()) # 隐藏图例标题

# 计算样本外策略表现指标

oos_performance <- data.frame(

Strategy = c(

"Large Cap Buy & Hold", "Small Cap Buy & Hold",

"Equal Weight Buy & Hold", "Momentum Rotation"

), # 策略名称

Total_Return = c(

oos_buy_hold_large_cap[length(oos_buy_hold_large_cap)], # 大盘股总收益

oos_buy_hold_small_cap[length(oos_buy_hold_small_cap)], # 小盘股总收益

oos_buy_hold_equal[length(oos_buy_hold_equal)], # 等权组合总收益

oos_result$xts$Cumulative_Returns[length(oos_result$xts$Cumulative_Returns)] # 动量策略总收益

),

Sharpe_Ratio = c(

SharpeRatio.annualized(oos_result$xts$Large_Cap_Returns), # 大盘股夏普比率

SharpeRatio.annualized(oos_result$xts$Small_Cap_Returns), # 小盘股夏普比率

SharpeRatio.annualized((oos_result$xts$Large_Cap_Returns + oos_result$xts$Small_Cap_Returns) / 2), # 等权组合夏普比率

SharpeRatio.annualized(oos_result$xts$Net_Returns) # 动量策略夏普比率

),

Max_Drawdown = c(

maxDrawdown(oos_result$xts$Large_Cap_Returns), # 大盘股最大回撤

maxDrawdown(oos_result$xts$Small_Cap_Returns), # 小盘股最大回撤

maxDrawdown((oos_result$xts$Large_Cap_Returns + oos_result$xts$Small_Cap_Returns) / 2), # 等权组合最大回撤

maxDrawdown(oos_result$xts$Net_Returns) # 动量策略最大回撤

)

)

# 打印样本外性能指标

print(oos_performance) # 输出策略比较结果

## Strategy Total_Return Sharpe_Ratio Max_Drawdown

## X2023.12.29 Large Cap Buy & Hold 0.7708001 2.9047901 0.1693780

## X2023.12.29.1 Small Cap Buy & Hold -0.1367801 -0.4796014 0.6159451

## X2023.12.29.2 Equal Weight Buy & Hold 0.3170100 0.6359367 0.3230760

## X2023.12.29.3 Momentum Rotation 0.4791532 0.7933869 0.2934326

结论

本文通过R语言实现了基于动量的大盘股/小盘股轮动策略,并进行了全面的分析。主要发现 如下:

- 动量轮动策略在回测期间表现出了优于简单买入持有策略的潜力,特别是在夏普比率方面。

- 通过参数优化,我们找到了最优的回看期、持有期和再平衡阈值组合,显著提高了策略的 表现。

- 参数敏感性分析表明,策略对回看期和持有期较为敏感,而对再平衡阈值的敏感性相对较 低。

- 样本外验证显示,优化后的策略在新数据上仍具有一定的有效性,但性能通常会有所下降, 这反映了过拟合的风险。

总体而言,基于动量的大盘股/小盘股轮动策略是一种可行的投资方法,但需要谨慎选择参数 并进行充分的样本外验证。在实际应用中,还应考虑交易成本、市场环境变化等因素的影响。

未来的研究可以考虑结合其他指标来改进策略,如波动率指标、市场情绪指标等,或者探索 在不同市场环境下的表现差异。