KDJ指标择时交易策略分析

引言

技术分析是金融市场中常用的分析方法,其中KDJ指标是一种重要的随机指标,能够反映价格波动的强弱、超买超卖现象以及市场趋势变化。本研究旨在通过R语言实现基于KDJ指标的股票择时交易策略,并通过历史数据回测寻找最佳参数组合。

研究方法

数据获取与处理

我们将使用quantmod包获取股票数据,并使用quantstrat包进行策略回测。首先加载所需的包:

# 加载必要的包

library(quantmod)

library(quantstrat)

library(eTTR)

library(PerformanceAnalytics)

library(ggplot2)

library(dplyr)

library(tibble)

library(scales)

library(gridExtra)

# 加载环境重置函数

source("/Users/matrixspk/My-Sites/r-finance/assets/code/reset_strategy_env.R")

# 加载计算胜率的函数

source("/Users/matrixspk/My-Sites/r-finance/assets/code/calculate_portfolio_win_rates.R")

source("/Users/matrixspk/My-Sites/r-finance/assets/code/generateSimpleSignalChain.R")

接下来,我们获取苹果公司股票的历史数据作为研究对象:

# 设置获取数据的起始和结束日期

initDate <- as.Date("2017-12-31")

startdate.st <- as.Date("2018-01-01")

enddate.st <- as.Date("2023-06-01")

# 获取苹果公司股票数据

getSymbols("AAPL", src = "yahoo", from = startdate.st, to = enddate.st)

## [1] "AAPL"

colnames(AAPL) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

# 查看数据结构

head(AAPL)

## Open High Low Close Volume Adjusted

## 2018-01-02 42.5400 43.0750 42.3150 43.0650 102223600 40.42682

## 2018-01-03 43.1325 43.6375 42.9900 43.0575 118071600 40.41978

## 2018-01-04 43.1350 43.3675 43.0200 43.2575 89738400 40.60754

## 2018-01-05 43.3600 43.8425 43.2625 43.7500 94640000 41.06986

## 2018-01-08 43.5875 43.9025 43.4825 43.5875 82271200 40.91732

## 2018-01-09 43.6375 43.7650 43.3525 43.5825 86336000 40.91263

summary(AAPL)

## Index Open High Low

## Min. :2018-01-02 Min. : 35.99 Min. : 36.43 Min. : 35.50

## 1st Qu.:2019-05-10 1st Qu.: 51.97 1st Qu.: 52.32 1st Qu.: 51.67

## Median :2020-09-15 Median :114.67 Median :116.07 Median :112.84

## Mean :2020-09-14 Mean :102.38 Mean :103.62 Mean :101.24

## 3rd Qu.:2022-01-20 3rd Qu.:146.36 3rd Qu.:148.00 3rd Qu.:145.15

## Max. :2023-05-31 Max. :182.63 Max. :182.94 Max. :179.12

## Close Volume Adjusted

## Min. : 35.55 Min. : 35195900 Min. : 33.87

## 1st Qu.: 52.03 1st Qu.: 76144000 1st Qu.: 49.73

## Median :114.97 Median : 98135650 Median :111.96

## Mean :102.48 Mean :112825725 Mean :100.02

## 3rd Qu.:146.61 3rd Qu.:133535000 3rd Qu.:143.97

## Max. :182.01 Max. :426510000 Max. :178.65

KDJ指标计算原理

KDJ指标由三条曲线组成:K线、D线和J线。其计算基于以下步骤:

计算未成熟随机值RSV: $$ RSV = \frac{C_t - L_n}{H_n - L_n} \times 100% $$

其中,$C_t$ 为当日收盘价,$L_n$ 为n日内最低价,$H_n$ 为n日内最高价。

计算K值、D值和J值: $$ K_{t} = \alpha \times RSV_{t} + (1-\alpha) \times K_{t-1} $$ $$ D_{t} = \beta \times K_t + (1-\beta) \times D_{t-1} $$ $$ J_t = 3 \times K_t - 2 \times D_t $$

通常,$\alpha = 1/3$,$\beta = 1/3$,$n=9$。

交易策略设计

我们将基于KDJ指标设计以下交易策略:

- 买入信号:当K线从下方上穿D线,并且K值和D值均小于20

- 卖出信号:当K线从上方下穿D线,并且K值和D值均大于80

下面我们使用quantstrat包实现这个策略:

# 清理历史环境对象

reset_strategy_env()

## 策略环境已重置

# 初始化quantstrat

rm(list = ls(.blotter))

rm(list = ls(.strategy))

# 设置初始参数

currency("USD")

## [1] "USD"

stock("AAPL", currency = "USD", multiplier = 1)

## [1] "AAPL"

initEq.st <- 1000000 # 初始资金

portfolio.st <- "KDJ_Portfolio"

strategy.st <- "KDJ_Strategy"

account.st <- "KDJ_Account"

symbols.st <- "AAPL"

# 初始化投资组合、账户和订单

initPortf(name=portfolio.st,

symbols = symbols.st,

initPosQty = 0)

## [1] "KDJ_Portfolio"

initAcct(name = account.st,

portfolios = portfolio.st,

initEq = initEq.st)

## [1] "KDJ_Account"

initOrders(portfolio = portfolio.st)

strategy(strategy.st, store = TRUE)

# 添加KDJ指标(修正参数)

add.indicator(strategy.st,

name = "KDJ",

arguments = list(ohlc = quote(HLC(AAPL)),

n = 9,

m1 = 3, # eTTR::KDJ的m1参数

m2 = 3), # eTTR::KDJ的m2参数

label = "KDJ_9_3_3")

## [1] "KDJ_Strategy"

# 添加交易信号

# 买入信号

add.signal(strategy.st,

name = "sigCrossover",

arguments = list(columns = c("K.KDJ_9_3_3", "D.KDJ_9_3_3"),

relationship = "gte"),

label = "K_gte_D")

## [1] "KDJ_Strategy"

add.signal(strategy.st,

name = "sigThreshold",

arguments = list(column = "K.KDJ_9_3_3",

threshold = 20,

relationship = "lt",

cross = FALSE),

label = "K_lt_20")

## [1] "KDJ_Strategy"

add.signal(strategy.st,

name = "sigThreshold",

arguments = list(column = "D.KDJ_9_3_3",

threshold = 20,

relationship = "lt",

cross = FALSE),

label = "D_lt_20")

## [1] "KDJ_Strategy"

add.signal("KDJ_Strategy",

name = "sigFormula",

arguments = list(formula = "K_gte_D & K_lt_20 & D_lt_20",

columns = c("K_gte_D", "K_lt_20", "D_lt_20"),

cross = FALSE),

label = "Buy_Signal")

## [1] "KDJ_Strategy"

# 卖出信号

add.signal(strategy.st,

name = "sigCrossover",

arguments = list(columns = c("K.KDJ_9_3_3", "D.KDJ_9_3_3"),

relationship = "lte"),

label = "K_lte_D")

## [1] "KDJ_Strategy"

add.signal(strategy.st,

name = "sigThreshold",

arguments = list(column = "K.KDJ_9_3_3",

threshold = 70,

relationship = "gt",

cross = FALSE),

label = "K_gt_70")

## [1] "KDJ_Strategy"

add.signal(strategy.st,

name = "sigThreshold",

arguments = list(column = "D.KDJ_9_3_3",

threshold = 70,

relationship = "gt",

cross = FALSE),

label = "D_gt_70")

## [1] "KDJ_Strategy"

add.signal("KDJ_Strategy",

name = "sigFormula",

arguments = list(formula = "K_lte_D & K_gt_70 & D_gt_70",

columns = c("K_lte_D", "K_gt_70", "D_gt_70"),

cross = FALSE),

label = "Sell_Signal")

## [1] "KDJ_Strategy"

# 添加交易规则

add.rule(strategy.st,

name = "ruleSignal",

arguments = list(sigcol = "Buy_Signal",

sigval = TRUE,

orderqty = 10000,

ordertype = "market",

orderside = "long",

replace = FALSE,

prefer = "Close"),

type = "enter",

label = "Enter_Long")

## [1] "KDJ_Strategy"

add.rule(strategy.st,

name = "ruleSignal",

arguments = list(sigcol = "Sell_Signal",

sigval = TRUE,

orderqty = "all",

ordertype = "market",

orderside = "long",

replace = FALSE,

prefer = "Close"),

type = "exit",

label = "Exit_Long")

## [1] "KDJ_Strategy"

# 添加止损规则

add.rule(strategy.st,

name = "ruleSignal",

arguments = list(threshold = 0.05,

sigcol = "Buy_Signal",

sigval = TRUE,

orderqty = "all",

ordertype = "stoplimit",

orderside = "long",

replace = FALSE,

prefer = "Close"),

type = "chain",

parent = "Enter_Long",

label = "Stop_Loss")

## [1] "KDJ_Strategy"

# 策略回测

tryCatch({

applyStrategy(strategy = strategy.st, portfolios = portfolio.st, mktdata = AAPL)

# 更新结果

updatePortf(portfolio.st)

updateAcct(account.st)

updateEndEq(account.st)

# 分析回测结果

port_ret <- PortfReturns(Account = account.st)

if (nrow(port_ret) > 0) {

# 计算绩效指标

sharpe_ratio <- SharpeRatio.annualized(port_ret, Rf = 0.02)

total_return <- Return.cumulative(port_ret)

max_drawdown <- maxDrawdown(port_ret)

cat("策略绩效指标:\n")

cat("夏普比率:", round(sharpe_ratio, 4), "\n")

cat("总回报率:", round(total_return, 4), "\n")

cat("最大回撤:", round(max_drawdown, 4), "\n")

# 绘制绩效图表

charts.PerformanceSummary(port_ret)

} else {

cat("警告: 策略未产生任何交易\n")

}

}, error = function(e) {

cat("回测失败:", e$message, "\n")

cat("请检查KDJ指标参数和数据格式\n")

})

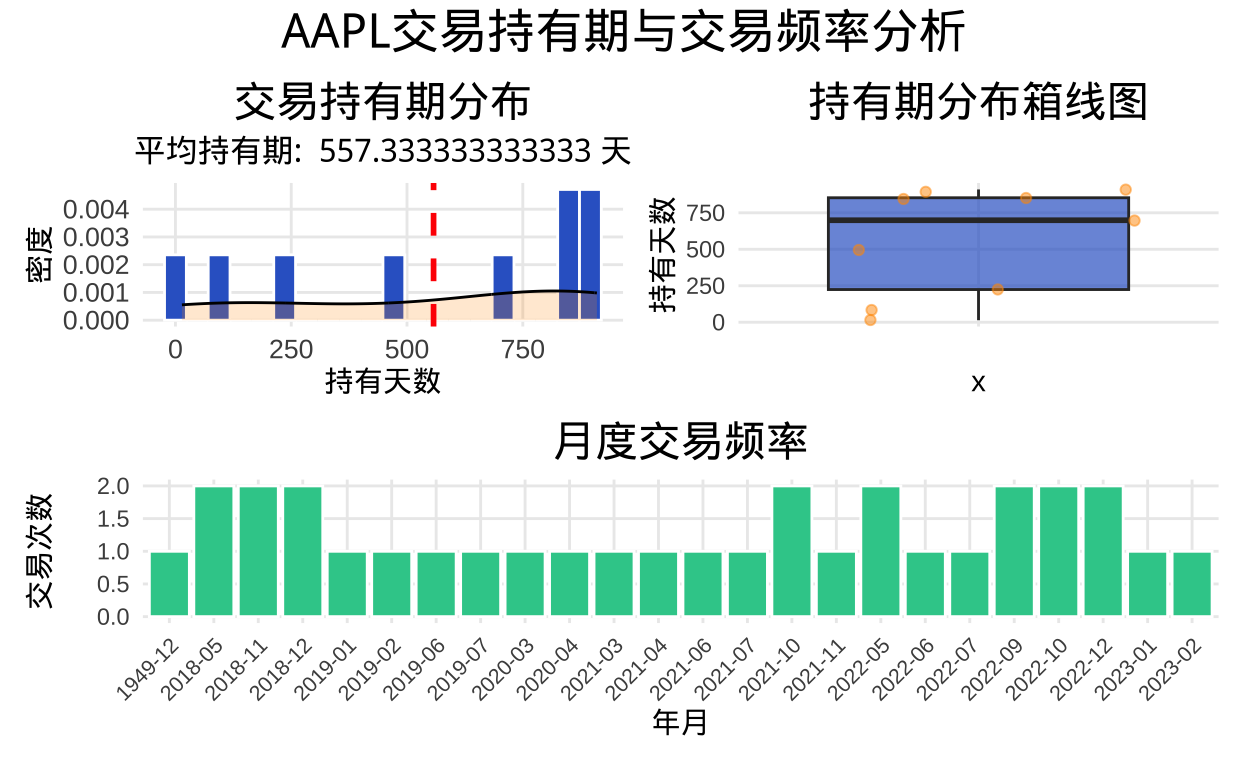

## [1] "2018-11-28 00:00:00 AAPL 10000 @ 45.2350006103516"

## [1] "2018-12-27 00:00:00 AAPL 10000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -20000 @ 42.3574981689453"

## [1] "2022-01-26 00:00:00 AAPL 10000 @ 159.690002441406"

## [1] "2022-02-11 00:00:00 AAPL -10000 @ 168.639999389648"

## [1] "2022-12-30 00:00:00 AAPL 10000 @ 129.929992675781"

## [1] "2023-01-31 00:00:00 AAPL -10000 @ 144.289993286133"

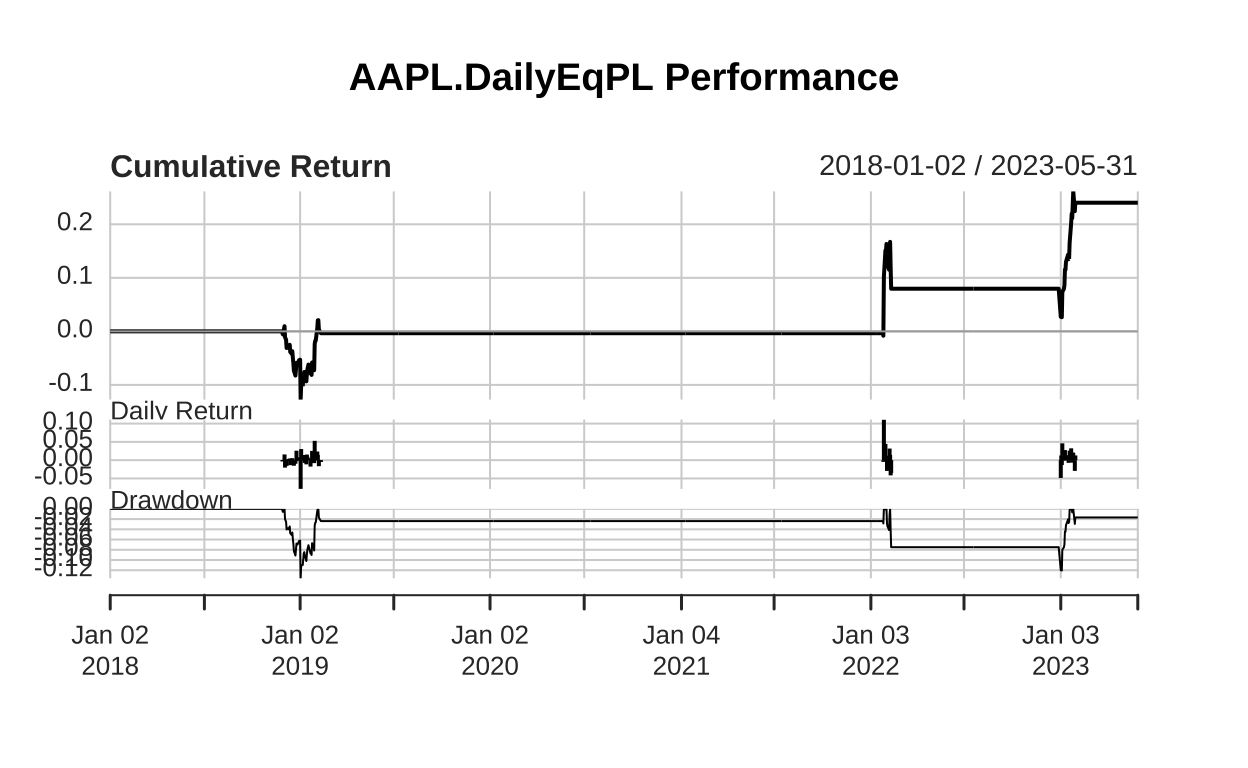

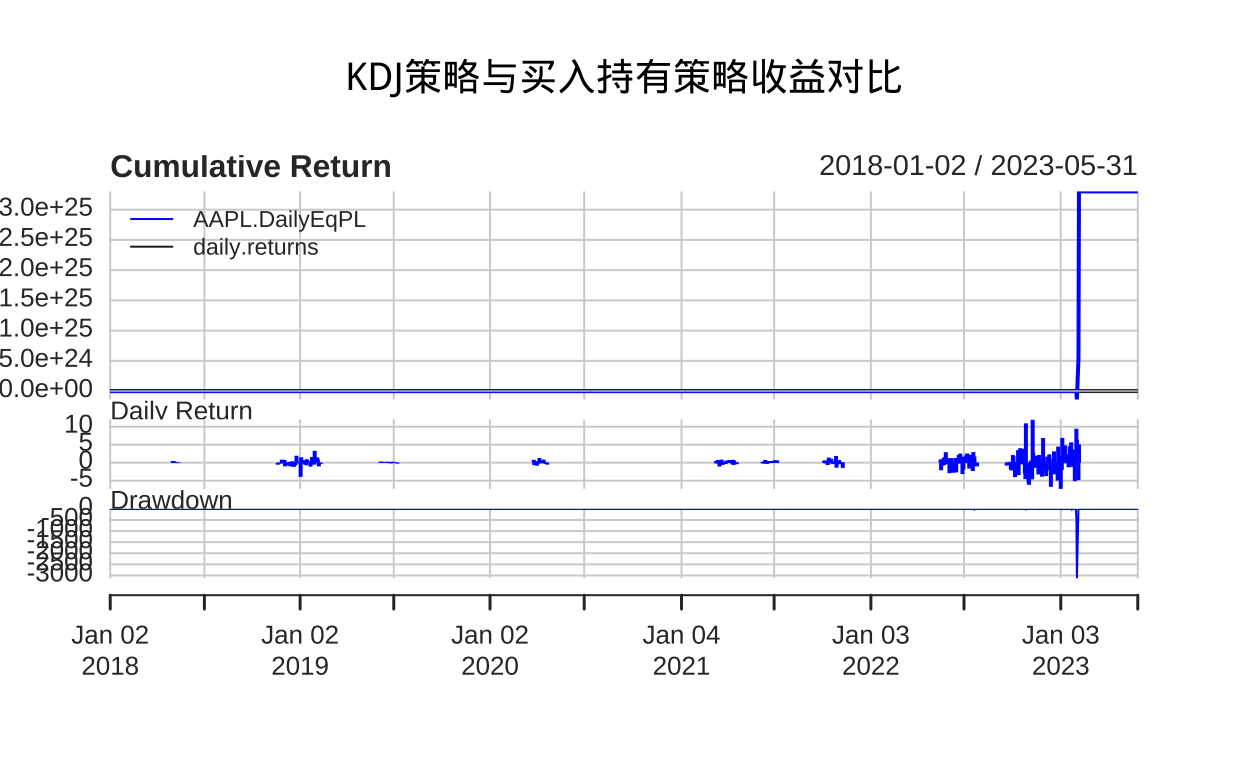

## 策略绩效指标:

## 夏普比率: -10.8848

## 总回报率: 0.2403

## 最大回撤: 0.1357

参数优化

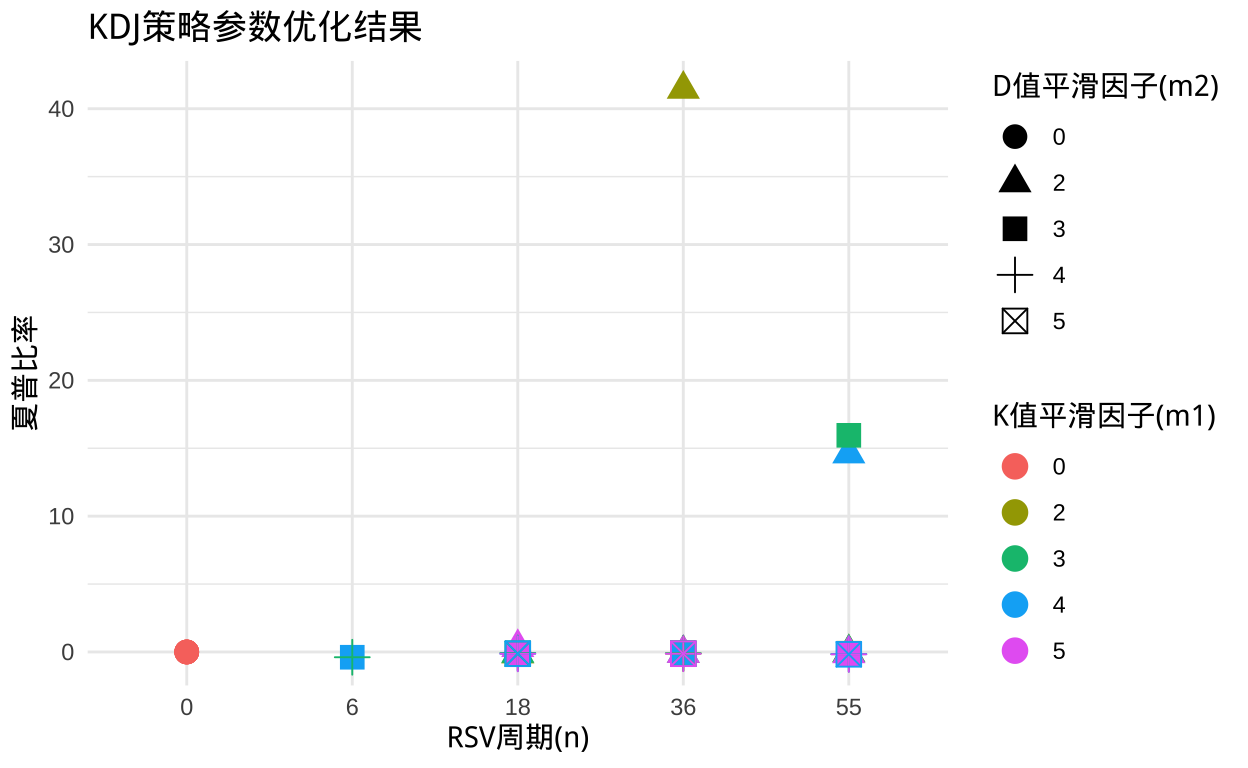

KDJ指标的主要参数包括RSV周期(n)、K值平滑因子(k)和D值平滑因子(d)。为了找到最佳参数组合,我们将进行参数网格搜索:

# 设置参数网格

n_values <- c(6, 18, 36, 55)# RSV周期(对应eTTR::KDJ的n参数)

m1_values <- c(2, 3, 4, 5) # K值平滑因子(对应eTTR::KDJ的m1参数)

m2_values <- c(2, 3, 4, 5) # D值平滑因子(对应eTTR::KDJ的m2参数)

# 创建参数组合

param_grid <- expand.grid(n = n_values, m1 = m1_values, m2 = m2_values)

n_combinations <- nrow(param_grid)

# 初始化结果存储

results <- data.frame(

n = numeric(n_combinations),

m1 = numeric(n_combinations),

m2 = numeric(n_combinations),

SharpeRatio = numeric(n_combinations),

Return = numeric(n_combinations),

MaxDrawdown = numeric(n_combinations),

TradeCount = numeric(n_combinations),

WinRate = numeric(n_combinations)

)

# 循环测试不同参数组合

for (i in 1:n_combinations) {

cat(paste0("测试参数组合 ", i, "/", n_combinations, ": n=",

param_grid$n[i], ", m1=", param_grid$m1[i], ", m2=", param_grid$m2[i], "\n"))

# 重置环境

reset_strategy_env()

# 设置初始参数

initEq.st <- 1000000 # 初始资金

portfolio.st <- "KDJ_Portfolio"

strategy.st <- "KDJ_Strategy"

account.st <- "KDJ_Account"

symbols.st <- "AAPL"

currency("USD")

stock(symbols.st, currency = "USD", multiplier = 1)

tryCatch({

# 初始化投资组合、账户和订单

initPortf(portfolio.st, symbols = symbols.st)

initAcct(account.st, portfolios = portfolio.st, initEq = initEq.st)

initOrders(portfolio = portfolio.st)

strategy(strategy.st, store = TRUE)

# 添加KDJ指标

indicator_label <- paste0("KDJ_", param_grid$n[i], "_", param_grid$m1[i], "_", param_grid$m2[i])

add.indicator(strategy.st,

name = "KDJ",

arguments = list(ohlc = quote(HLC(AAPL)),

n = param_grid$n[i],

m1 = param_grid$m1[i], # eTTR::KDJ的m1参数(K值平滑因子)

m2 = param_grid$m2[i]), # eTTR::KDJ的m2参数(D值平滑因子)

label = indicator_label)

# 生成指标列名

k_col <- paste0("K.", indicator_label)

d_col <- paste0("D.", indicator_label)

# 买入信号

add.signal(strategy.st, "sigCrossover",

list(columns = c(k_col, d_col), relationship = "gte"),

label = "K_gte_D")

add.signal(strategy.st, "sigThreshold",

list(column = k_col, threshold = 20, relationship = "lt"),

label = "K_lt_20")

add.signal(strategy.st, "sigThreshold",

list(column = d_col, threshold = 20, relationship = "lt"),

label = "D_lt_20")

add.signal(strategy.st, "sigFormula",

list(signals = c("K_gte_D", "K_lt_20", "D_lt_20"),

formula = "K_gte_D & K_lt_20 & D_lt_20"),

label = "Buy_Signal")

# 卖出信号

add.signal(strategy.st, "sigCrossover",

list(columns = c(k_col, d_col), relationship = "lte"),

label = "K_lte_D")

add.signal(strategy.st, "sigThreshold",

list(column = k_col, threshold = 70, relationship = "gt"),

label = "K_gt_70")

add.signal(strategy.st, "sigThreshold",

list(column = d_col, threshold = 70, relationship = "gt"),

label = "D_gt_70")

add.signal(strategy.st, "sigFormula",

list(signals = c("K_lte_D", "K_gt_70", "D_gt_70"),

formula = "K_lte_D & K_gt_70 & D_gt_70"),

label = "Sell_Signal")

# 添加交易规则

add.rule(strategy.st, "ruleSignal",

list(sigcol = "Buy_Signal", sigval = TRUE,

orderqty = 250000, ordertype = "market",

orderside = "long", replace = FALSE),

type = "enter", label = "Enter_Long")

add.rule(strategy.st, "ruleSignal",

list(sigcol = "Sell_Signal", sigval = TRUE,

orderqty = "all", ordertype = "market",

orderside = "long", replace = FALSE),

type = "exit", label = "Exit_Long")

# 添加止损规则

add.rule(strategy.st, "ruleSignal",

list(threshold = 0.10,

sigcol = "Buy_Signal",

sigval = TRUE,

orderqty = "all",

ordertype = "stoplimit",

orderside = "long",

replace = FALSE),

type = "chain",

parent = "Enter_Long",

label = "Stop_Loss_10%")

# 运行回测

out <- applyStrategy(strategy = strategy.st,

portfolios = portfolio.st,

mktdata = AAPL)

# 更新回测结果

updatePortf(portfolio.st)

updateAcct(account.st)

updateEndEq(account.st)

# 获取策略收益

port_ret <- PortfReturns(Account = account.st)

# 计算评估指标

if (nrow(port_ret) > 0) {

sharpe_ratio <- SharpeRatio.annualized(port_ret, Rf = 0.02,scale = 252)

total_return <- Return.cumulative(port_ret)

max_drawdown <- maxDrawdown(port_ret)

# 交易分析

trades <- getTxns(Portfolio = portfolio.st, Symbol = "AAPL")

trade_count <- nrow(trades)

win_rate_result <- calculate_portfolio_win_rates(tradeStats(portfolio.st))

win_rate <- as.numeric(win_rate_result[,"Win_Rate"])

# 存储结果

results[i, ] <- c(param_grid$n[i], param_grid$m1[i], param_grid$m2[i],

sharpe_ratio, total_return, max_drawdown, trade_count, win_rate)

cat(paste0("✅ 测试完成 | Sharpe: ", round(sharpe_ratio, 4),

" | 总收益: ", round(total_return, 4),

" | 最大回撤: ", round(max_drawdown, 4),

" | 交易次数: ", trade_count,

" | 胜率: ", round(win_rate, 2), "\n"))

} else {

cat("⚠️ 警告: 无交易记录,可能参数设置过严\n")

}

}, error = function(e) {

cat(paste0("❌ 策略执行失败 | 参数组合 ", i, " | 错误: ", e$message, "\n"))

})

}

## 测试参数组合 1/64: n=6, m1=2, m2=2

## 策略环境已重置

## [1] "2018-02-01 00:00:00 AAPL 250000 @ 41.9449996948242"

## [1] "2018-02-21 00:00:00 AAPL -250000 @ 42.7675018310547"

## [1] "2018-11-16 00:00:00 AAPL 250000 @ 48.3824996948242"

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2019-02-08 00:00:00 AAPL -5e+05 @ 42.6025009155273"

## [1] "2019-05-31 00:00:00 AAPL 250000 @ 43.7675018310547"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-14 00:00:00 AAPL -5e+05 @ 48.185001373291"

## [1] "2020-03-02 00:00:00 AAPL 250000 @ 74.7024993896484"

## [1] "2020-03-24 00:00:00 AAPL 250000 @ 61.7200012207031"

## [1] "2020-04-20 00:00:00 AAPL -5e+05 @ 69.2324981689453"

## [1] "2021-09-22 00:00:00 AAPL 250000 @ 145.850006103516"

## [1] "2021-10-25 00:00:00 AAPL -250000 @ 148.639999389648"

## [1] "2022-06-16 00:00:00 AAPL 250000 @ 130.059997558594"

## [1] "2022-06-21 00:00:00 AAPL 250000 @ 135.869995117188"

## [1] "2022-07-12 00:00:00 AAPL -5e+05 @ 145.860000610352"

## [1] "2022-09-02 00:00:00 AAPL 250000 @ 155.809997558594"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2022-10-04 00:00:00 AAPL 250000 @ 146.100006103516"

## [1] "2022-10-27 00:00:00 AAPL -750000 @ 144.800003051758"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1.0115 | 最大回撤: 1.0115 | 交易次数: 21 | 胜率: 0.71

## 测试参数组合 2/64: n=18, m1=2, m2=2

## 策略环境已重置

## [1] "2018-02-12 00:00:00 AAPL 250000 @ 40.6775016784668"

## [1] "2018-03-02 00:00:00 AAPL -250000 @ 44.0525016784668"

## [1] "2018-04-04 00:00:00 AAPL 250000 @ 42.9025001525879"

## [1] "2018-04-20 00:00:00 AAPL -250000 @ 41.4300003051758"

## [1] "2018-05-01 00:00:00 AAPL 250000 @ 42.2750015258789"

## [1] "2018-05-15 00:00:00 AAPL -250000 @ 46.6100006103516"

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2018-12-12 00:00:00 AAPL 250000 @ 42.2750015258789"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-08 00:00:00 AAPL -1e+06 @ 42.6025009155273"

## [1] "2019-05-31 00:00:00 AAPL 250000 @ 43.7675018310547"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-26 00:00:00 AAPL -5e+05 @ 49.9500007629395"

## [1] "2020-09-16 00:00:00 AAPL 250000 @ 112.129997253418"

## [1] "2020-09-22 00:00:00 AAPL 250000 @ 111.809997558594"

## [1] "2020-10-15 00:00:00 AAPL -5e+05 @ 120.709999084473"

## [1] "2021-03-10 00:00:00 AAPL 250000 @ 119.980003356934"

## [1] "2021-04-15 00:00:00 AAPL -250000 @ 134.5"

## [1] "2021-10-04 00:00:00 AAPL 250000 @ 139.139999389648"

## [1] "2021-10-06 00:00:00 AAPL 250000 @ 142"

## [1] "2021-10-26 00:00:00 AAPL -5e+05 @ 149.320007324219"

## [1] "2022-01-25 00:00:00 AAPL 250000 @ 159.779998779297"

## [1] "2022-02-08 00:00:00 AAPL -250000 @ 174.830001831055"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-07-19 00:00:00 AAPL -250000 @ 151"

## [1] "2022-09-12 00:00:00 AAPL 250000 @ 163.429992675781"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-28 00:00:00 AAPL -5e+05 @ 155.740005493164"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2022-12-30 00:00:00 AAPL 250000 @ 129.929992675781"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-01-31 00:00:00 AAPL -750000 @ 144.289993286133"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1352 | 总收益: -1.0279 | 最大回撤: 1.0108 | 交易次数: 34 | 胜率: 0.75

## 测试参数组合 3/64: n=36, m1=2, m2=2

## 策略环境已重置

## [1] "2018-05-01 00:00:00 AAPL 250000 @ 42.2750015258789"

## [1] "2018-05-15 00:00:00 AAPL -250000 @ 46.6100006103516"

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-02-11 00:00:00 AAPL -1250000 @ 42.3574981689453"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-07-09 00:00:00 AAPL -250000 @ 50.310001373291"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-04-21 00:00:00 AAPL -250000 @ 67.0924987792969"

## [1] "2021-03-10 00:00:00 AAPL 250000 @ 119.980003356934"

## [1] "2021-04-21 00:00:00 AAPL -250000 @ 133.5"

## [1] "2021-06-07 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-07-07 00:00:00 AAPL -250000 @ 144.570007324219"

## [1] "2021-10-04 00:00:00 AAPL 250000 @ 139.139999389648"

## [1] "2021-10-06 00:00:00 AAPL 250000 @ 142"

## [1] "2021-11-11 00:00:00 AAPL -5e+05 @ 147.869995117188"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-07-26 00:00:00 AAPL -750000 @ 151.600006103516"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-09-29 00:00:00 AAPL 250000 @ 142.479995727539"

## [1] "2022-10-04 00:00:00 AAPL 250000 @ 146.100006103516"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2022-12-30 00:00:00 AAPL 250000 @ 129.929992675781"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1750000 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: 41.4412 | 总收益: 3.30279074337661e+25 | 最大回撤: 3126.5533 | 交易次数: 32 | 胜率: 1

## 测试参数组合 4/64: n=55, m1=2, m2=2

## 策略环境已重置

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-01-16 00:00:00 AAPL 250000 @ 38.7350006103516"

## [1] "2019-01-28 00:00:00 AAPL 250000 @ 39.0750007629395"

## [1] "2019-03-07 00:00:00 AAPL -1750000 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-12 00:00:00 AAPL -250000 @ 50.8250007629395"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-18 00:00:00 AAPL -250000 @ 78.7399978637695"

## [1] "2021-03-10 00:00:00 AAPL 250000 @ 119.980003356934"

## [1] "2021-03-30 00:00:00 AAPL 250000 @ 119.900001525879"

## [1] "2021-04-01 00:00:00 AAPL 250000 @ 123"

## [1] "2021-04-23 00:00:00 AAPL -750000 @ 134.320007324219"

## [1] "2021-10-04 00:00:00 AAPL 250000 @ 139.139999389648"

## [1] "2021-10-06 00:00:00 AAPL 250000 @ 142"

## [1] "2021-11-29 00:00:00 AAPL -5e+05 @ 160.240005493164"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-08-09 00:00:00 AAPL -750000 @ 164.919998168945"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2022-12-30 00:00:00 AAPL 250000 @ 129.929992675781"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-10 00:00:00 AAPL -1250000 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0517 | 总收益: 126892019.8311 | 最大回撤: 6.8141 | 交易次数: 30 | 胜率: 1

## 测试参数组合 5/64: n=6, m1=3, m2=2

## 策略环境已重置

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2019-05-31 00:00:00 AAPL 250000 @ 43.7675018310547"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-17 00:00:00 AAPL -5e+05 @ 48.4724998474121"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2023-01-19 00:00:00 AAPL -250000 @ 135.270004272461"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.2291 | 交易次数: 8 | 胜率: 0.33

## 测试参数组合 6/64: n=18, m1=3, m2=2

## 策略环境已重置

## [1] "2018-02-07 00:00:00 AAPL 250000 @ 39.8849983215332"

## [1] "2018-03-02 00:00:00 AAPL -250000 @ 44.0525016784668"

## [1] "2018-04-04 00:00:00 AAPL 250000 @ 42.9025001525879"

## [1] "2018-04-20 00:00:00 AAPL -250000 @ 41.4300003051758"

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-12 00:00:00 AAPL 250000 @ 42.2750015258789"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-08 00:00:00 AAPL -1e+06 @ 42.6025009155273"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-26 00:00:00 AAPL -250000 @ 49.9500007629395"

## [1] "2020-09-22 00:00:00 AAPL 250000 @ 111.809997558594"

## [1] "2020-10-16 00:00:00 AAPL -250000 @ 119.019996643066"

## [1] "2021-02-24 00:00:00 AAPL 250000 @ 125.349998474121"

## [1] "2021-03-11 00:00:00 AAPL 250000 @ 121.959999084473"

## [1] "2021-04-15 00:00:00 AAPL -5e+05 @ 134.5"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-10-28 00:00:00 AAPL -250000 @ 152.570007324219"

## [1] "2022-01-26 00:00:00 AAPL 250000 @ 159.690002441406"

## [1] "2022-02-14 00:00:00 AAPL -250000 @ 168.880004882812"

## [1] "2022-04-29 00:00:00 AAPL 250000 @ 157.649993896484"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-19 00:00:00 AAPL -750000 @ 151"

## [1] "2022-09-12 00:00:00 AAPL 250000 @ 163.429992675781"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-28 00:00:00 AAPL -1e+06 @ 155.740005493164"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-01-31 00:00:00 AAPL -750000 @ 144.289993286133"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0869 | 总收益: 1085.4944 | 最大回撤: 2.99 | 交易次数: 34 | 胜率: 0.82

## 测试参数组合 7/64: n=36, m1=3, m2=2

## 策略环境已重置

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-02-12 00:00:00 AAPL -1250000 @ 42.7224998474121"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-10 00:00:00 AAPL -250000 @ 50.8074989318848"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-13 00:00:00 AAPL -250000 @ 76.9124984741211"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-22 00:00:00 AAPL -250000 @ 131.940002441406"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-07-26 00:00:00 AAPL -750000 @ 151.600006103516"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-10 00:00:00 AAPL -1e+06 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1004 | 总收益: -0.9874 | 最大回撤: 4.434 | 交易次数: 24 | 胜率: 1

## 测试参数组合 8/64: n=55, m1=3, m2=2

## 策略环境已重置

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-01-16 00:00:00 AAPL 250000 @ 38.7350006103516"

## [1] "2019-01-28 00:00:00 AAPL 250000 @ 39.0750007629395"

## [1] "2019-03-08 00:00:00 AAPL -1750000 @ 43.2275009155273"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-08-01 00:00:00 AAPL -250000 @ 52.1074981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-28 00:00:00 AAPL -250000 @ 79.5625"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-01 00:00:00 AAPL 250000 @ 123"

## [1] "2021-05-03 00:00:00 AAPL -5e+05 @ 132.539993286133"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-29 00:00:00 AAPL -250000 @ 160.240005493164"

## [1] "2022-03-17 00:00:00 AAPL 250000 @ 160.619995117188"

## [1] "2022-04-07 00:00:00 AAPL -250000 @ 172.139999389648"

## [1] "2022-05-17 00:00:00 AAPL 250000 @ 149.240005493164"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-08-10 00:00:00 AAPL -750000 @ 169.240005493164"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-11-11 00:00:00 AAPL 250000 @ 149.699996948242"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-13 00:00:00 AAPL -1250000 @ 153.850006103516"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0429 | 总收益: 1131484107.8157 | 最大回撤: 731.8759 | 交易次数: 30 | 胜率: 1

## 测试参数组合 9/64: n=6, m1=4, m2=2

## 策略环境已重置

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-17 00:00:00 AAPL -250000 @ 48.4724998474121"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2023-01-20 00:00:00 AAPL -250000 @ 137.869995117188"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.0966 | 交易次数: 7 | 胜率: 0.33

## 测试参数组合 10/64: n=18, m1=4, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-08 00:00:00 AAPL -750000 @ 42.6025009155273"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-06-26 00:00:00 AAPL -250000 @ 49.9500007629395"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-04-21 00:00:00 AAPL -250000 @ 67.0924987792969"

## [1] "2020-09-23 00:00:00 AAPL 250000 @ 107.120002746582"

## [1] "2020-09-28 00:00:00 AAPL 250000 @ 114.959999084473"

## [1] "2020-10-19 00:00:00 AAPL -5e+05 @ 115.980003356934"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-01 00:00:00 AAPL -250000 @ 148.960006713867"

## [1] "2022-04-29 00:00:00 AAPL 250000 @ 157.649993896484"

## [1] "2022-05-03 00:00:00 AAPL 250000 @ 159.479995727539"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-26 00:00:00 AAPL -1e+06 @ 151.600006103516"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1500000 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1.63824951922408e+31 | 最大回撤: 537.8647 | 交易次数: 26 | 胜率: 1

## 测试参数组合 11/64: n=36, m1=4, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-07 00:00:00 AAPL -1e+06 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-22 00:00:00 AAPL -250000 @ 51.8050003051758"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-23 00:00:00 AAPL -250000 @ 134.320007324219"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-23 00:00:00 AAPL 250000 @ 138.270004272461"

## [1] "2022-07-27 00:00:00 AAPL -750000 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-10 00:00:00 AAPL -1e+06 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -2881.9695 | 最大回撤: 77.341 | 交易次数: 23 | 胜率: 1

## 测试参数组合 12/64: n=55, m1=4, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-08 00:00:00 AAPL -1e+06 @ 43.2275009155273"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-08-01 00:00:00 AAPL -250000 @ 52.1074981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-01 00:00:00 AAPL 250000 @ 123"

## [1] "2021-05-03 00:00:00 AAPL -5e+05 @ 132.539993286133"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-29 00:00:00 AAPL -250000 @ 160.240005493164"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-23 00:00:00 AAPL 250000 @ 138.270004272461"

## [1] "2022-08-19 00:00:00 AAPL -750000 @ 171.520004272461"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2022-11-11 00:00:00 AAPL 250000 @ 149.699996948242"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -1500000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: 14.5922 | 总收益: 5.15945247500254e+22 | 最大回撤: 537.8647 | 交易次数: 26 | 胜率: 1

## 测试参数组合 13/64: n=6, m1=5, m2=2

## 策略环境已重置

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2022-09-09 00:00:00 AAPL 250000 @ 157.369995117188"

## [1] "2023-01-31 00:00:00 AAPL -250000 @ 144.289993286133"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.0252 | 交易次数: 5 | 胜率: 0

## 测试参数组合 14/64: n=18, m1=5, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -750000 @ 42.3574981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-01 00:00:00 AAPL -250000 @ 50.3875007629395"

## [1] "2020-09-28 00:00:00 AAPL 250000 @ 114.959999084473"

## [1] "2020-10-19 00:00:00 AAPL -250000 @ 115.980003356934"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-02 00:00:00 AAPL -250000 @ 150.020004272461"

## [1] "2022-05-17 00:00:00 AAPL 250000 @ 149.240005493164"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -5e+05 @ 156.789993286133"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1250000 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: 0.3329 | 总收益: 2693125516525510 | 最大回撤: 731.8759 | 交易次数: 20 | 胜率: 1

## 测试参数组合 15/64: n=36, m1=5, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-07 00:00:00 AAPL -1e+06 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-29 00:00:00 AAPL -250000 @ 52.4199981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-10 00:00:00 AAPL -750000 @ 169.240005493164"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -750000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0977 | 总收益: 4241.9639 | 最大回撤: 77.341 | 交易次数: 22 | 胜率: 1

## 测试参数组合 16/64: n=55, m1=5, m2=2

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -1e+06 @ 47.185001373291"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-08-01 00:00:00 AAPL -250000 @ 52.1074981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -5e+05 @ 128.100006103516"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-29 00:00:00 AAPL -250000 @ 160.240005493164"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -750000 @ 167.570007324219"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1193 | 总收益: -1 | 最大回撤: 37.159 | 交易次数: 22 | 胜率: 1

## 测试参数组合 17/64: n=6, m1=2, m2=3

## 策略环境已重置

## [1] "2018-11-27 00:00:00 AAPL 250000 @ 43.560001373291"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2019-05-31 00:00:00 AAPL 250000 @ 43.7675018310547"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-17 00:00:00 AAPL -5e+05 @ 48.4724998474121"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2023-01-19 00:00:00 AAPL -250000 @ 135.270004272461"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.2291 | 交易次数: 8 | 胜率: 0.33

## 测试参数组合 18/64: n=18, m1=2, m2=3

## 策略环境已重置

## [1] "2018-04-04 00:00:00 AAPL 250000 @ 42.9025001525879"

## [1] "2018-04-20 00:00:00 AAPL -250000 @ 41.4300003051758"

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-12 00:00:00 AAPL 250000 @ 42.2750015258789"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-08 00:00:00 AAPL -1e+06 @ 42.6025009155273"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-26 00:00:00 AAPL -250000 @ 49.9500007629395"

## [1] "2020-09-22 00:00:00 AAPL 250000 @ 111.809997558594"

## [1] "2020-10-16 00:00:00 AAPL -250000 @ 119.019996643066"

## [1] "2021-03-11 00:00:00 AAPL 250000 @ 121.959999084473"

## [1] "2021-04-15 00:00:00 AAPL -250000 @ 134.5"

## [1] "2022-01-26 00:00:00 AAPL 250000 @ 159.690002441406"

## [1] "2022-02-14 00:00:00 AAPL -250000 @ 168.880004882812"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-07-19 00:00:00 AAPL -250000 @ 151"

## [1] "2022-09-12 00:00:00 AAPL 250000 @ 163.429992675781"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-28 00:00:00 AAPL -5e+05 @ 155.740005493164"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-01-31 00:00:00 AAPL -750000 @ 144.289993286133"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1471 | 总收益: -1 | 最大回撤: 1.0039 | 交易次数: 25 | 胜率: 0.67

## 测试参数组合 19/64: n=36, m1=2, m2=3

## 策略环境已重置

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-02-12 00:00:00 AAPL -1250000 @ 42.7224998474121"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-10 00:00:00 AAPL -250000 @ 50.8074989318848"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-13 00:00:00 AAPL -250000 @ 76.9124984741211"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-22 00:00:00 AAPL -250000 @ 131.940002441406"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-07-26 00:00:00 AAPL -750000 @ 151.600006103516"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-10 00:00:00 AAPL -1e+06 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1004 | 总收益: -0.9874 | 最大回撤: 4.434 | 交易次数: 24 | 胜率: 1

## 测试参数组合 20/64: n=55, m1=2, m2=3

## 策略环境已重置

## [1] "2018-11-19 00:00:00 AAPL 250000 @ 46.4650001525879"

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-01-16 00:00:00 AAPL 250000 @ 38.7350006103516"

## [1] "2019-01-28 00:00:00 AAPL 250000 @ 39.0750007629395"

## [1] "2019-03-08 00:00:00 AAPL -1750000 @ 43.2275009155273"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-08-01 00:00:00 AAPL -250000 @ 52.1074981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-28 00:00:00 AAPL -250000 @ 79.5625"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-01 00:00:00 AAPL 250000 @ 123"

## [1] "2021-05-03 00:00:00 AAPL -5e+05 @ 132.539993286133"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-29 00:00:00 AAPL -250000 @ 160.240005493164"

## [1] "2022-05-17 00:00:00 AAPL 250000 @ 149.240005493164"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-22 00:00:00 AAPL 250000 @ 135.350006103516"

## [1] "2022-08-10 00:00:00 AAPL -750000 @ 169.240005493164"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-13 00:00:00 AAPL -1e+06 @ 153.850006103516"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0912 | 总收益: -0.9686 | 最大回撤: 8.3985 | 交易次数: 27 | 胜率: 1

## 测试参数组合 21/64: n=6, m1=3, m2=3

## 策略环境已重置

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2023-01-20 00:00:00 AAPL -250000 @ 137.869995117188"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.0435 | 交易次数: 5 | 胜率: 0

## 测试参数组合 22/64: n=18, m1=3, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -750000 @ 42.3574981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-06-26 00:00:00 AAPL -250000 @ 49.9500007629395"

## [1] "2020-09-23 00:00:00 AAPL 250000 @ 107.120002746582"

## [1] "2020-09-28 00:00:00 AAPL 250000 @ 114.959999084473"

## [1] "2020-10-19 00:00:00 AAPL -5e+05 @ 115.980003356934"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-01 00:00:00 AAPL -250000 @ 148.960006713867"

## [1] "2022-04-29 00:00:00 AAPL 250000 @ 157.649993896484"

## [1] "2022-05-03 00:00:00 AAPL 250000 @ 159.479995727539"

## [1] "2022-05-17 00:00:00 AAPL 250000 @ 149.240005493164"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-26 00:00:00 AAPL -1e+06 @ 151.600006103516"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1250000 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -8.66122433252946e+30 | 最大回撤: 1530.7447 | 交易次数: 23 | 胜率: 0.83

## 测试参数组合 23/64: n=36, m1=3, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-07 00:00:00 AAPL -1e+06 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-22 00:00:00 AAPL -250000 @ 51.8050003051758"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-23 00:00:00 AAPL -250000 @ 134.320007324219"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-23 00:00:00 AAPL 250000 @ 138.270004272461"

## [1] "2022-07-27 00:00:00 AAPL -750000 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-13 00:00:00 AAPL -1e+06 @ 153.850006103516"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -11063.9561 | 最大回撤: 77.341 | 交易次数: 23 | 胜率: 1

## 测试参数组合 24/64: n=55, m1=3, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-08 00:00:00 AAPL -1e+06 @ 43.2275009155273"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-08-01 00:00:00 AAPL -250000 @ 52.1074981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-03 00:00:00 AAPL -5e+05 @ 132.539993286133"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-29 00:00:00 AAPL -250000 @ 160.240005493164"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -750000 @ 167.570007324219"

## [1] "2022-10-07 00:00:00 AAPL 250000 @ 140.089996337891"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2022-11-11 00:00:00 AAPL 250000 @ 149.699996948242"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -1250000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: 15.9522 | 总收益: 1.24184050378993e+23 | 最大回撤: 1530.7447 | 交易次数: 25 | 胜率: 1

## 测试参数组合 25/64: n=6, m1=4, m2=3

## 策略环境已重置

## [1] "2022-09-09 00:00:00 AAPL 250000 @ 157.369995117188"

## [1] "2022-11-01 00:00:00 AAPL -250000 @ 150.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.3884 | 总收益: -0.9997 | 最大回撤: 2.9111 | 交易次数: 3 | 胜率: 0

## 测试参数组合 26/64: n=18, m1=4, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -750000 @ 42.3574981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-01 00:00:00 AAPL -250000 @ 50.3875007629395"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-04-22 00:00:00 AAPL -250000 @ 69.0250015258789"

## [1] "2020-09-28 00:00:00 AAPL 250000 @ 114.959999084473"

## [1] "2020-10-20 00:00:00 AAPL -250000 @ 117.51000213623"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-02 00:00:00 AAPL -250000 @ 150.020004272461"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1e+06 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.073 | 总收益: 19654821.038 | 最大回撤: 283.8463 | 交易次数: 20 | 胜率: 1

## 测试参数组合 27/64: n=36, m1=4, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-08 00:00:00 AAPL 250000 @ 37.6875"

## [1] "2019-03-07 00:00:00 AAPL -750000 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-29 00:00:00 AAPL -250000 @ 52.4199981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-15 00:00:00 AAPL 250000 @ 123.98999786377"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-12 00:00:00 AAPL -250000 @ 149.990005493164"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-10 00:00:00 AAPL -750000 @ 169.240005493164"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -750000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0957 | 总收益: 71537.7174 | 最大回撤: 77.341 | 交易次数: 21 | 胜率: 1

## 测试参数组合 28/64: n=55, m1=4, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -750000 @ 47.185001373291"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-08-02 00:00:00 AAPL -250000 @ 51.0050010681152"

## [1] "2020-03-26 00:00:00 AAPL 250000 @ 64.6100006103516"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -5e+05 @ 128.100006103516"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-12-06 00:00:00 AAPL -250000 @ 165.320007324219"

## [1] "2022-05-25 00:00:00 AAPL 250000 @ 140.520004272461"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 13.259 | 交易次数: 20 | 胜率: 1

## 测试参数组合 29/64: n=6, m1=5, m2=3

## 策略环境已重置

## ❌ 策略执行失败 | 参数组合 29 | 错误: 输入必须是tradeStats函数的输出数据框

## 测试参数组合 30/64: n=18, m1=5, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-12 00:00:00 AAPL -750000 @ 42.7224998474121"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-09 00:00:00 AAPL -250000 @ 50.310001373291"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-09 00:00:00 AAPL -750000 @ 150.869995117188"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1318 | 总收益: -0.6638 | 最大回撤: 2.0731 | 交易次数: 13 | 胜率: 1

## 测试参数组合 31/64: n=36, m1=5, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-03-08 00:00:00 AAPL -5e+05 @ 43.2275009155273"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-07-31 00:00:00 AAPL -250000 @ 53.2599983215332"

## [1] "2020-03-26 00:00:00 AAPL 250000 @ 64.6100006103516"

## [1] "2020-05-15 00:00:00 AAPL -250000 @ 76.9274978637695"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-12 00:00:00 AAPL -250000 @ 149.990005493164"

## [1] "2022-05-25 00:00:00 AAPL 250000 @ 140.520004272461"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-22 00:00:00 AAPL -1e+06 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -394550425625.057 | 最大回撤: 283.8463 | 交易次数: 20 | 胜率: 1

## 测试参数组合 32/64: n=55, m1=5, m2=3

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -750000 @ 47.185001373291"

## [1] "2020-03-26 00:00:00 AAPL 250000 @ 64.6100006103516"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -5e+05 @ 128.100006103516"

## [1] "2022-05-27 00:00:00 AAPL 250000 @ 149.639999389648"

## [1] "2022-06-27 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-19 00:00:00 AAPL 250000 @ 143.860000610352"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1586 | 总收益: -1 | 最大回撤: 8.6726 | 交易次数: 16 | 胜率: 1

## 测试参数组合 33/64: n=6, m1=2, m2=4

## 策略环境已重置

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## [1] "2019-06-04 00:00:00 AAPL 250000 @ 44.9099998474121"

## [1] "2019-06-17 00:00:00 AAPL -250000 @ 48.4724998474121"

## [1] "2022-09-08 00:00:00 AAPL 250000 @ 154.460006713867"

## [1] "2023-01-31 00:00:00 AAPL -250000 @ 144.289993286133"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.0966 | 交易次数: 7 | 胜率: 0.33

## 测试参数组合 34/64: n=18, m1=2, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-08 00:00:00 AAPL -750000 @ 42.6025009155273"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-06-26 00:00:00 AAPL -250000 @ 49.9500007629395"

## [1] "2020-09-23 00:00:00 AAPL 250000 @ 107.120002746582"

## [1] "2020-10-19 00:00:00 AAPL -250000 @ 115.980003356934"

## [1] "2022-05-03 00:00:00 AAPL 250000 @ 159.479995727539"

## [1] "2022-05-16 00:00:00 AAPL 250000 @ 145.539993286133"

## [1] "2022-07-26 00:00:00 AAPL -5e+05 @ 151.600006103516"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-12-22 00:00:00 AAPL 250000 @ 132.229995727539"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1e+06 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -0.9996 | 最大回撤: 3.1034 | 交易次数: 17 | 胜率: 0.8

## 测试参数组合 35/64: n=36, m1=2, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-07 00:00:00 AAPL -1e+06 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-22 00:00:00 AAPL -250000 @ 51.8050003051758"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-23 00:00:00 AAPL -250000 @ 134.320007324219"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-11 00:00:00 AAPL -250000 @ 147.869995117188"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-23 00:00:00 AAPL 250000 @ 138.270004272461"

## [1] "2022-07-27 00:00:00 AAPL -5e+05 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-10 00:00:00 AAPL -1e+06 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1125 | 总收益: -0.8153 | 最大回撤: 2.6909 | 交易次数: 22 | 胜率: 1

## 测试参数组合 36/64: n=55, m1=2, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-08 00:00:00 AAPL -1e+06 @ 43.2275009155273"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-01 00:00:00 AAPL 250000 @ 123"

## [1] "2021-05-03 00:00:00 AAPL -5e+05 @ 132.539993286133"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-23 00:00:00 AAPL 250000 @ 138.270004272461"

## [1] "2022-08-19 00:00:00 AAPL -5e+05 @ 171.520004272461"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -1250000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -652899478681.471 | 最大回撤: 731.8759 | 交易次数: 20 | 胜率: 1

## 测试参数组合 37/64: n=6, m1=3, m2=4

## 策略环境已重置

## [1] "2022-09-09 00:00:00 AAPL 250000 @ 157.369995117188"

## [1] "2022-11-01 00:00:00 AAPL -250000 @ 150.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.3884 | 总收益: -0.9997 | 最大回撤: 2.9111 | 交易次数: 3 | 胜率: 0

## 测试参数组合 38/64: n=18, m1=3, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -750000 @ 42.3574981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-01 00:00:00 AAPL -250000 @ 50.3875007629395"

## [1] "2020-09-28 00:00:00 AAPL 250000 @ 114.959999084473"

## [1] "2020-12-11 00:00:00 AAPL -250000 @ 122.410003662109"

## [1] "2021-10-07 00:00:00 AAPL 250000 @ 143.289993286133"

## [1] "2021-11-02 00:00:00 AAPL -250000 @ 150.020004272461"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -1e+06 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0737 | 总收益: 13116774.6652 | 最大回撤: 283.8463 | 交易次数: 18 | 胜率: 1

## 测试参数组合 39/64: n=36, m1=3, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-08 00:00:00 AAPL 250000 @ 37.6875"

## [1] "2019-03-07 00:00:00 AAPL -750000 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-29 00:00:00 AAPL -250000 @ 52.4199981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-15 00:00:00 AAPL 250000 @ 123.98999786377"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-11-12 00:00:00 AAPL -250000 @ 149.990005493164"

## [1] "2022-05-18 00:00:00 AAPL 250000 @ 140.820007324219"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-10 00:00:00 AAPL -750000 @ 169.240005493164"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -750000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.0957 | 总收益: 71537.7174 | 最大回撤: 77.341 | 交易次数: 21 | 胜率: 1

## 测试参数组合 40/64: n=55, m1=3, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -750000 @ 47.185001373291"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-08-02 00:00:00 AAPL -250000 @ 51.0050010681152"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -5e+05 @ 128.100006103516"

## [1] "2021-10-08 00:00:00 AAPL 250000 @ 142.899993896484"

## [1] "2021-12-06 00:00:00 AAPL -250000 @ 165.320007324219"

## [1] "2022-05-25 00:00:00 AAPL 250000 @ 140.520004272461"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1566 | 总收益: -1 | 最大回撤: 8.6726 | 交易次数: 18 | 胜率: 1

## 测试参数组合 41/64: n=6, m1=4, m2=4

## 策略环境已重置

## ❌ 策略执行失败 | 参数组合 41 | 错误: 输入必须是tradeStats函数的输出数据框

## 测试参数组合 42/64: n=18, m1=4, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-12 00:00:00 AAPL -750000 @ 42.7224998474121"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-09 00:00:00 AAPL -250000 @ 50.310001373291"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-09 00:00:00 AAPL -750000 @ 150.869995117188"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1318 | 总收益: -0.6638 | 最大回撤: 2.0731 | 交易次数: 13 | 胜率: 1

## 测试参数组合 43/64: n=36, m1=4, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-03-08 00:00:00 AAPL -5e+05 @ 43.2275009155273"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-07-31 00:00:00 AAPL -250000 @ 53.2599983215332"

## [1] "2020-03-26 00:00:00 AAPL 250000 @ 64.6100006103516"

## [1] "2020-05-15 00:00:00 AAPL -250000 @ 76.9274978637695"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2021-10-11 00:00:00 AAPL 250000 @ 142.809997558594"

## [1] "2021-11-12 00:00:00 AAPL -250000 @ 149.990005493164"

## [1] "2022-05-25 00:00:00 AAPL 250000 @ 140.520004272461"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-22 00:00:00 AAPL -1e+06 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -403631770935.152 | 最大回撤: 283.8463 | 交易次数: 20 | 胜率: 1

## 测试参数组合 44/64: n=55, m1=4, m2=4

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -750000 @ 47.185001373291"

## [1] "2020-03-26 00:00:00 AAPL 250000 @ 64.6100006103516"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -5e+05 @ 128.100006103516"

## [1] "2022-05-27 00:00:00 AAPL 250000 @ 149.639999389648"

## [1] "2022-06-27 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-19 00:00:00 AAPL 250000 @ 143.860000610352"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1586 | 总收益: -1 | 最大回撤: 8.6726 | 交易次数: 16 | 胜率: 1

## 测试参数组合 45/64: n=6, m1=5, m2=4

## 策略环境已重置

## ❌ 策略执行失败 | 参数组合 45 | 错误: 输入必须是tradeStats函数的输出数据框

## 测试参数组合 46/64: n=18, m1=5, m2=4

## 策略环境已重置

## [1] "2018-11-30 00:00:00 AAPL 250000 @ 44.6450004577637"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-13 00:00:00 AAPL -750000 @ 42.5449981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-09 00:00:00 AAPL -250000 @ 50.310001373291"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-08-10 00:00:00 AAPL -250000 @ 169.240005493164"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-10 00:00:00 AAPL -750000 @ 151.009994506836"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1304 | 总收益: 0.4396 | 最大回撤: 2.8766 | 交易次数: 13 | 胜率: 1

## 测试参数组合 47/64: n=36, m1=5, m2=4

## 策略环境已重置

## [1] "2018-11-30 00:00:00 AAPL 250000 @ 44.6450004577637"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-03-08 00:00:00 AAPL -5e+05 @ 43.2275009155273"

## [1] "2019-06-06 00:00:00 AAPL 250000 @ 46.3050003051758"

## [1] "2019-07-31 00:00:00 AAPL -250000 @ 53.2599983215332"

## [1] "2021-03-16 00:00:00 AAPL 250000 @ 125.569999694824"

## [1] "2021-05-03 00:00:00 AAPL -250000 @ 132.539993286133"

## [1] "2022-05-27 00:00:00 AAPL 250000 @ 149.639999389648"

## [1] "2022-08-22 00:00:00 AAPL -250000 @ 167.570007324219"

## [1] "2022-10-06 00:00:00 AAPL 250000 @ 145.429992675781"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-22 00:00:00 AAPL -750000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1293 | 总收益: -1.0006 | 最大回撤: 3.6896 | 交易次数: 14 | 胜率: 1

## 测试参数组合 48/64: n=55, m1=5, m2=4

## 策略环境已重置

## [1] "2018-11-30 00:00:00 AAPL 250000 @ 44.6450004577637"

## [1] "2018-12-28 00:00:00 AAPL 250000 @ 39.0574989318848"

## [1] "2019-03-26 00:00:00 AAPL -5e+05 @ 46.6974983215332"

## [1] "2021-04-05 00:00:00 AAPL 250000 @ 125.900001525879"

## [1] "2021-05-05 00:00:00 AAPL -250000 @ 128.100006103516"

## [1] "2022-05-27 00:00:00 AAPL 250000 @ 149.639999389648"

## [1] "2022-06-27 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-23 00:00:00 AAPL -5e+05 @ 167.229995727539"

## [1] "2022-10-19 00:00:00 AAPL 250000 @ 143.860000610352"

## [1] "2023-01-10 00:00:00 AAPL 250000 @ 130.729995727539"

## [1] "2023-02-23 00:00:00 AAPL -5e+05 @ 149.399993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1732 | 总收益: -1 | 最大回撤: 9.2317 | 交易次数: 12 | 胜率: 1

## 测试参数组合 49/64: n=6, m1=2, m2=5

## 策略环境已重置

## [1] "2018-11-28 00:00:00 AAPL 250000 @ 45.2350006103516"

## [1] "2019-02-08 00:00:00 AAPL -250000 @ 42.6025009155273"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -0.9937 | 最大回撤: 0.9986 | 交易次数: 3 | 胜率: 0

## 测试参数组合 50/64: n=18, m1=2, m2=5

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-11 00:00:00 AAPL -750000 @ 42.3574981689453"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-01 00:00:00 AAPL -250000 @ 50.3875007629395"

## [1] "2022-05-17 00:00:00 AAPL 250000 @ 149.240005493164"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-09-20 00:00:00 AAPL 250000 @ 156.899993896484"

## [1] "2023-01-03 00:00:00 AAPL 250000 @ 125.069999694824"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-07 00:00:00 AAPL -750000 @ 154.649993896484"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.2053 | 交易次数: 13 | 胜率: 1

## 测试参数组合 51/64: n=36, m1=2, m2=5

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-07 00:00:00 AAPL -1e+06 @ 43.125"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-29 00:00:00 AAPL -250000 @ 52.4199981689453"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-05-14 00:00:00 AAPL -250000 @ 77.3850021362305"

## [1] "2021-03-12 00:00:00 AAPL 250000 @ 121.029998779297"

## [1] "2021-04-30 00:00:00 AAPL -250000 @ 131.460006713867"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-10 00:00:00 AAPL -5e+05 @ 169.240005493164"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -750000 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: -0.1159 | 总收益: 0.1361 | 最大回撤: 5.4834 | 交易次数: 19 | 胜率: 1

## 测试参数组合 52/64: n=55, m1=2, m2=5

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-14 00:00:00 AAPL 250000 @ 41.3699989318848"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-01-09 00:00:00 AAPL 250000 @ 38.3274993896484"

## [1] "2019-03-25 00:00:00 AAPL -1e+06 @ 47.185001373291"

## [1] "2020-03-25 00:00:00 AAPL 250000 @ 61.3800010681152"

## [1] "2020-06-12 00:00:00 AAPL -250000 @ 84.6999969482422"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-06-24 00:00:00 AAPL 250000 @ 141.660003662109"

## [1] "2022-08-22 00:00:00 AAPL -5e+05 @ 167.570007324219"

## [1] "2022-10-18 00:00:00 AAPL 250000 @ 143.75"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"

## [1] "2023-02-22 00:00:00 AAPL -5e+05 @ 148.910003662109"

## === 基于tradeStats的胜率计算结果 ===

## ✅ 测试完成 | Sharpe: NaN | 总收益: -1 | 最大回撤: 1.8988 | 交易次数: 14 | 胜率: 1

## 测试参数组合 53/64: n=6, m1=3, m2=5

## 策略环境已重置

## ❌ 策略执行失败 | 参数组合 53 | 错误: 输入必须是tradeStats函数的输出数据框

## 测试参数组合 54/64: n=18, m1=3, m2=5

## 策略环境已重置

## [1] "2018-11-29 00:00:00 AAPL 250000 @ 44.8875007629395"

## [1] "2018-12-13 00:00:00 AAPL 250000 @ 42.7374992370605"

## [1] "2018-12-27 00:00:00 AAPL 250000 @ 39.0374984741211"

## [1] "2019-02-12 00:00:00 AAPL -750000 @ 42.7224998474121"

## [1] "2019-06-05 00:00:00 AAPL 250000 @ 45.6349983215332"

## [1] "2019-07-09 00:00:00 AAPL -250000 @ 50.310001373291"

## [1] "2022-05-24 00:00:00 AAPL 250000 @ 140.360000610352"

## [1] "2022-07-27 00:00:00 AAPL -250000 @ 156.789993286133"

## [1] "2022-10-05 00:00:00 AAPL 250000 @ 146.399993896484"

## [1] "2022-10-14 00:00:00 AAPL 250000 @ 138.380004882812"

## [1] "2023-01-09 00:00:00 AAPL 250000 @ 130.149993896484"