均值回归策略有效性分析

引言

均值回归是金融市场中的一种重要现象,指资产价格或收益率在长期内趋向于回归其历史平 均值。基于这一理论的交易策略通常假设价格偏离其均值后会回归,因此可以通过买入低价 资产、卖出高价资产来获利。

本文将通过R语言实现均值回归策略,并验证其有效性。我们将选取多只股票作为样本,优化 策略参数,并在样本外数据上验证策略的表现。

数据准备与分析

首先加载必要的R包并获取股票数据。我们将选取几只具有代表性的美国科技股作为研究对象。

# 加载必要的R包

library(quantmod)

library(PerformanceAnalytics)

library(foreach)

library(doParallel)

library(ggplot2)

library(dplyr)

library(tidyr)

library(eTTR)

library(zoo)

接下来,我们获取多只股票的历史数据。这里选择了苹果(AAPL)、微软(MSFT)、谷歌(GOOG)、 亚马逊(AMZN)和特斯拉(TSLA)作为样本。

# 设置起止日期

start_date <- "2018-01-01"

end_date <- "2023-01-01"

out_of_sample_date <- "2023-01-02"

end_oos_date <- "2023-12-31"

# 股票代码列表

stock_symbols <- c("AAPL", "MSFT", "GOOG", "AMZN", "TSLA")

# 获取股票数据

stock_data <- list()

for (symbol in stock_symbols) {

data_raw <- getSymbols(symbol, from = start_date, to = end_date, auto.assign = FALSE)

colnames(data_raw) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

stock_data[[symbol]] <- data_raw

}

# 获取样本外数据

oos_data <- list()

for (symbol in stock_symbols) {

data_raw <- getSymbols(symbol, from = out_of_sample_date, to = end_oos_date, auto.assign = FALSE)

colnames(data_raw) <- c("Open", "High", "Low", "Close", "Volume", "Adjusted")

oos_data[[symbol]] <- data_raw

}

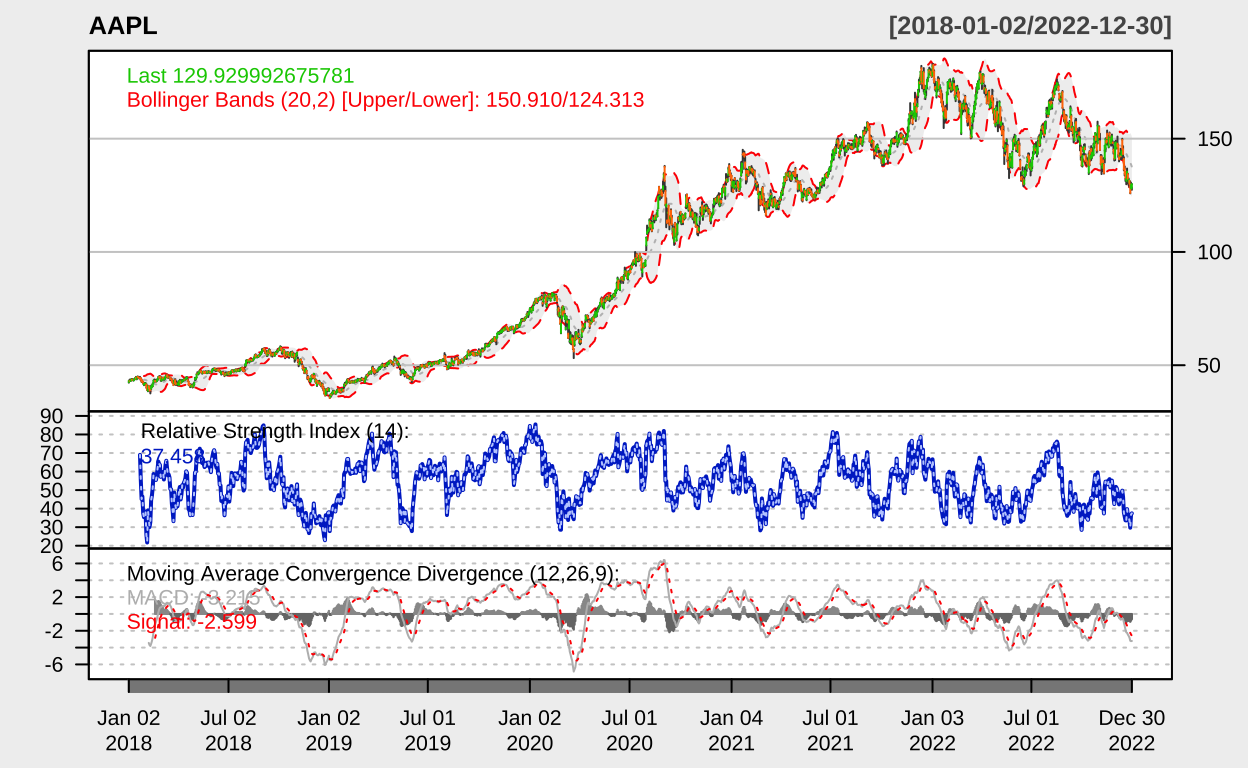

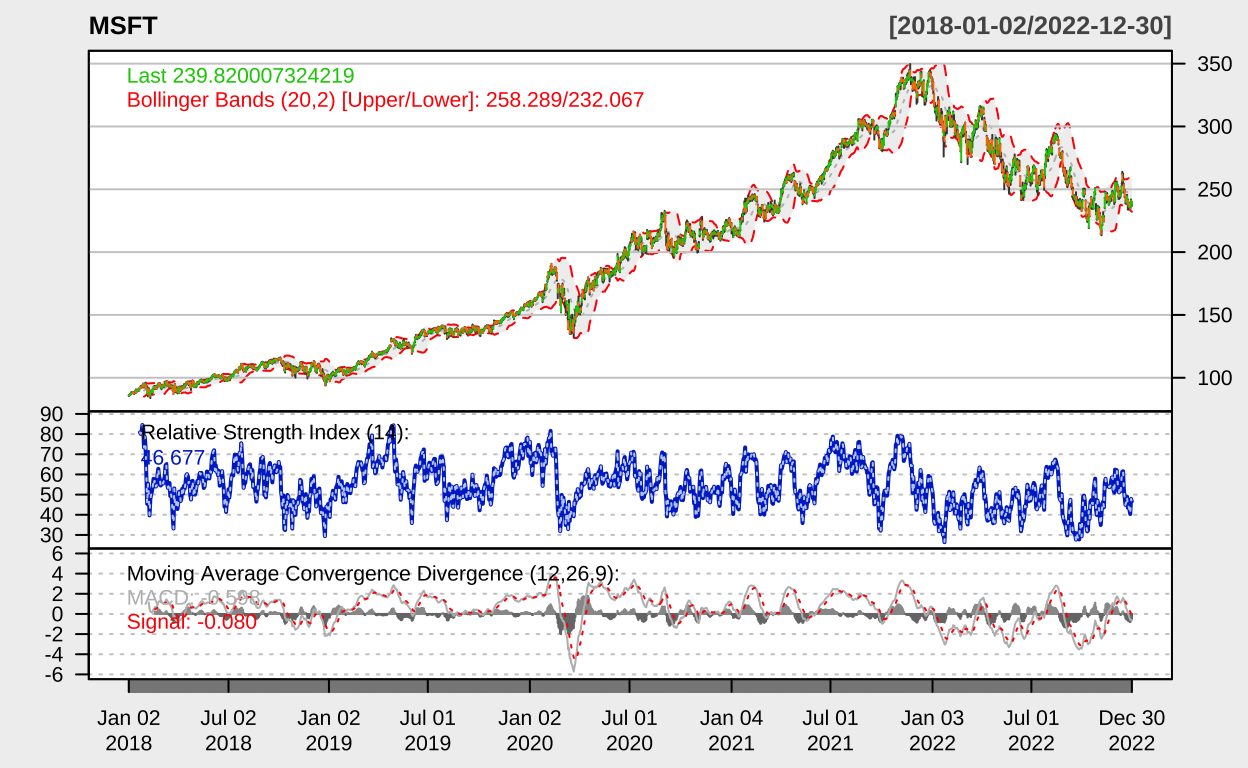

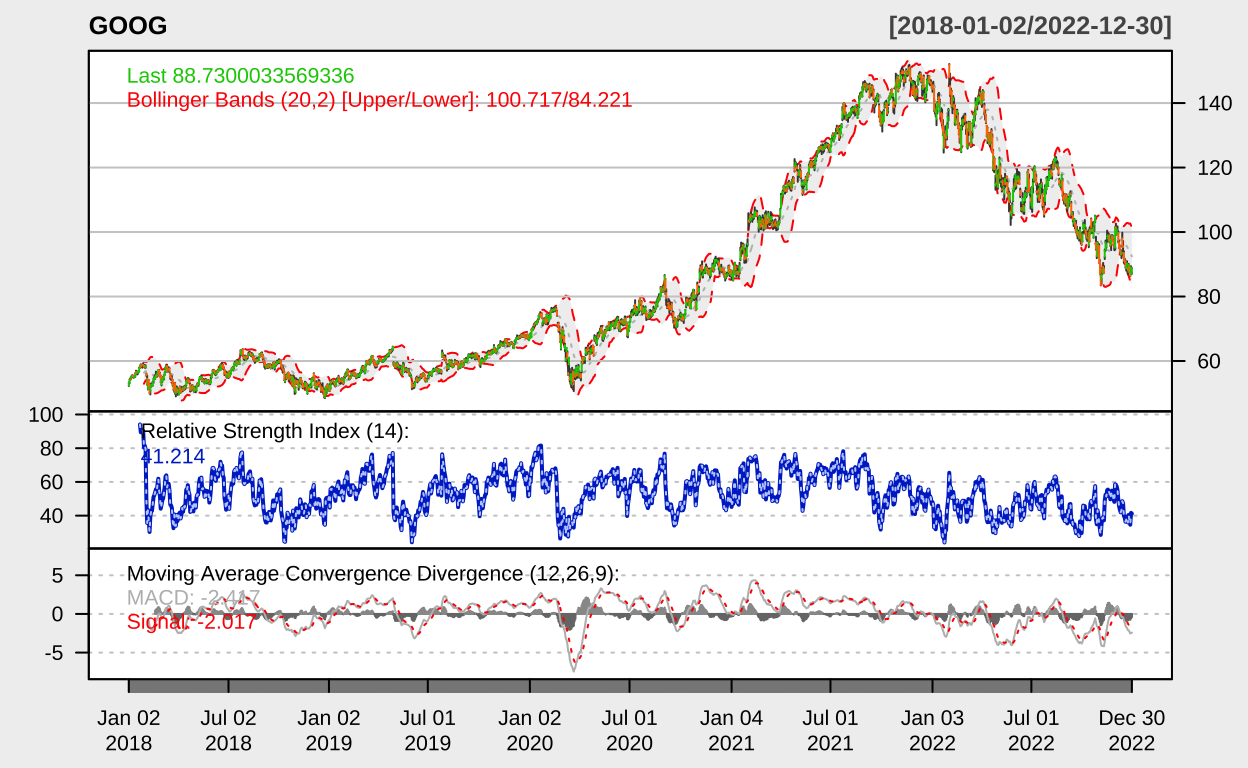

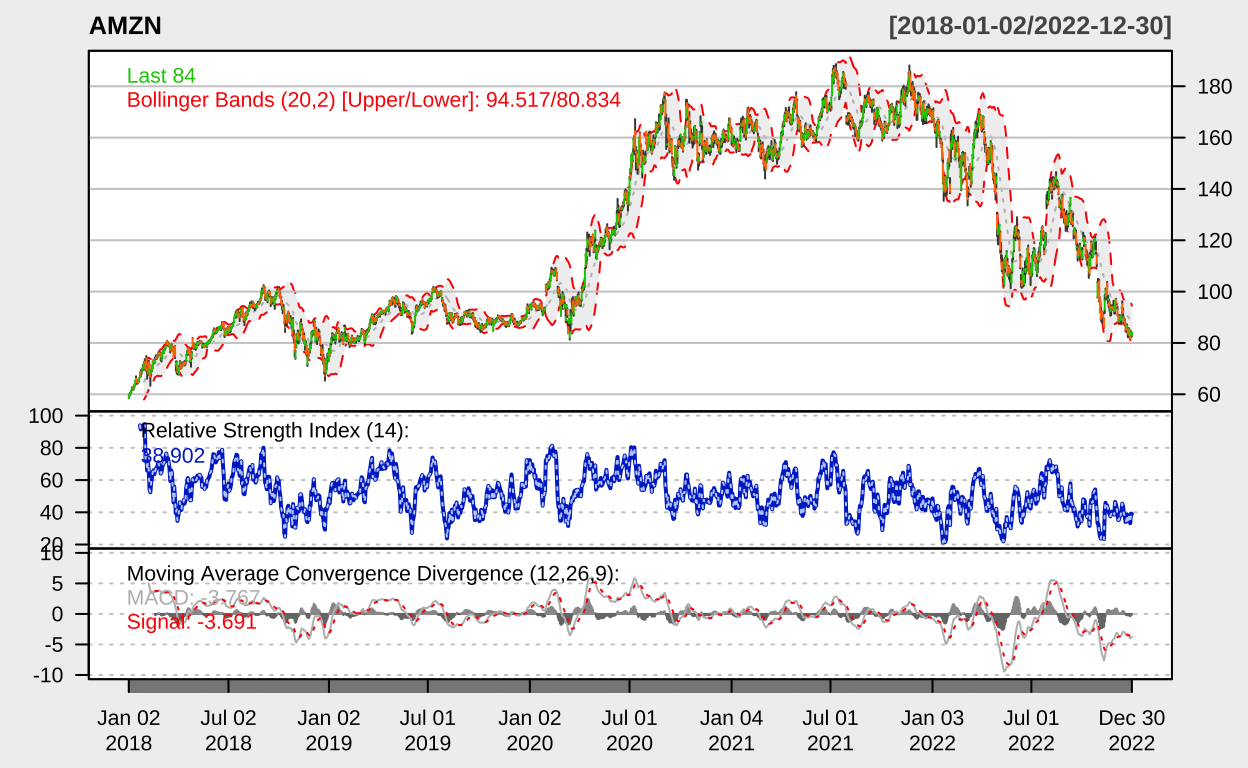

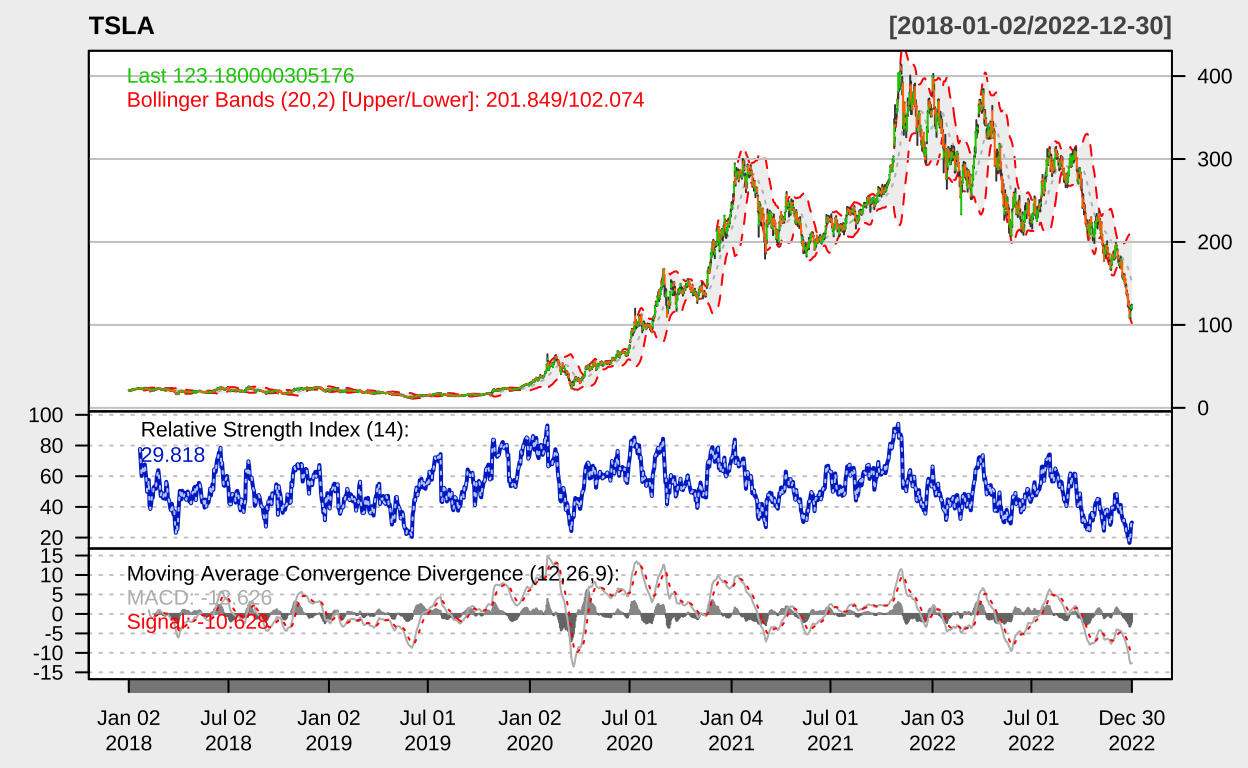

让我们可视化这些股票的价格走势,以便对数据有一个直观的了解。

# 创建一个图表展示所有股票的价格走势

par(mfrow = c(3, 2), mar = c(4, 4, 2, 1))

for (symbol in stock_symbols) {

chartSeries(stock_data[[symbol]], theme = "white", name = symbol,

TA = "addBBands(); addRSI(); addMACD()")

}

均值回归策略实现

下面我们实现一个简单的均值回归策略,基于布林带指标。该策略的核心思想是:当价格触 及下轨时买入,触及上轨时卖出。

首先定义一个函数来实现这个策略:

# 定义均值回归策略函数

mean_reversion_strategy <- function(data, ma_period = 20, sd_mult = 2,

trade_size = 10000, commission = 0.001) {

# 计算布林带

bbands <- eTTR::BBands(data[, "Close"], n = ma_period, sd = sd_mult)

# 初始化信号和持仓

signals <- rep(0, nrow(data))

position <- rep(0, nrow(data))

# 生成交易信号

for (i in (ma_period + 1):nrow(data)) {

# 当价格低于下轨时买入

if (data[i, "Close"] < bbands[i, "dn"]) {

signals[i] <- 1

}

# 当价格高于上轨时卖出

else if (data[i, "Close"] > bbands[i, "up"]) {

signals[i] <- -1

}

}

# 生成持仓

for (i in 2:nrow(data)) {

position[i] <- position[i-1] + signals[i]

# 限制持仓为-1, 0, 1

position[i] <- max(-1, min(1, position[i]))

}

# 计算每日收益

returns <- diff(log(data[, "Close"]))

returns <- zoo::na.fill(returns, 0) # 将 NA 填充为 0

# 计算策略收益

strategy_returns <- position * returns

strategy_returns <- zoo::na.fill(strategy_returns, 0) # 将 NA 填充为 0

# 考虑交易成本

trades <- abs(diff(position)) > 0

trades <- c(0, trades)

commission_cost <- trades * commission * trade_size

# 计算净收益

net_returns <- strategy_returns - commission_cost / trade_size

net_returns <- zoo::na.fill(net_returns, 0) # 将 NA 填充为 0

# 计算累积收益

cumulative_returns <- exp(cumsum(net_returns))-1

# 返回结果

results <- data.frame(

Date = zoo::index(data),

Close = zoo::coredata(data)[, "Close"],

Signal = signals,

Position = position,

Returns = returns,

Strategy_Returns = strategy_returns,

Commission_Cost = commission_cost,

Net_Returns = net_returns,

Cumulative_Returns = cumulative_returns

)

colnames(results) <- c("Date", "Close", "Signal", "Position",

"Returns", "Strategy_Returns", "Commission_Cost",

"Net_Returns", "Cumulative_Returns")

return(results)

}

现在我们将这个策略应用到每只股票上,并评估其表现:

# 应用策略到每只股票

strategy_results <- list()

for (symbol in stock_symbols) {

strategy_results[[symbol]] <- mean_reversion_strategy(stock_data[[symbol]])

}

# 计算每只股票的策略表现

performance_metrics <- data.frame(Symbol = character(),

Total_Return = numeric(),

Sharpe_Ratio = numeric(),

Max_Drawdown = numeric(),

stringsAsFactors = FALSE)

for (symbol in stock_symbols) {

results <- strategy_results[[symbol]]

# 检查结果是否存在且包含必要的列

if (is.null(results) || !all(c("Cumulative_Returns", "Net_Returns") %in% colnames(results))) {

warning(paste("策略结果对", symbol, "不完整,跳过该股票"))

next

}

# 计算总收益

total_return <- results$Cumulative_Returns[nrow(results)]

# 计算夏普比率 (假设无风险利率为0)

returns_xts <- NULL

# 确保Net_Returns是xts格式

if(!is.xts(results$Net_Returns)) {

# 如果Net_Returns不是xts,尝试转换

if("Date" %in% colnames(results)) {

library(xts)

# 增加日期有效性检查

valid_dates <- try(as.Date(results$Date), silent = TRUE)

if (!inherits(valid_dates, "try-error") && all(!is.na(valid_dates))) {

returns_xts <- xts(results$Net_Returns, order.by = valid_dates)

} else {

warning(paste("无法为", symbol, "转换有效日期,使用索引作为时间"))

returns_xts <- xts(results$Net_Returns, order.by = 1:nrow(results))

}

} else {

# 如果没有日期信息,创建基于索引的xts对象

warning(paste("策略结果对", symbol, "缺少日期信息,使用索引作为时间"))

returns_xts <- xts(results$Net_Returns, order.by = 1:nrow(results))

}

} else {

returns_xts <- results$Net_Returns

}

# 验证returns_xts是否有效且非空

if (is.null(returns_xts) || nrow(returns_xts) == 0 || all(is.na(returns_xts))) {

warning(paste("策略结果对", symbol, "没有有效的收益数据,使用NA作为性能指标"))

sharpe_ratio <- NA

max_drawdown <- NA

} else {

# 计算年化指标

annual_returns <- PerformanceAnalytics::Return.annualized(returns_xts, scale = 252)

sharpe_ratio <- PerformanceAnalytics::SharpeRatio.annualized(returns_xts, Rf = 0, scale = 252)

# 计算最大回撤

max_drawdown <- PerformanceAnalytics::maxDrawdown(returns_xts)

}

# 添加到性能指标数据框

performance_metrics <- rbind(performance_metrics,

data.frame(Symbol = symbol,

Total_Return = total_return,

Sharpe_Ratio = sharpe_ratio,

Max_Drawdown = max_drawdown))

colnames(performance_metrics) <- c("Symbol", "Total_Return", "Sharpe_Ratio", "Max_Drawdown")

row.names(performance_metrics) <- NULL

}

print(performance_metrics)

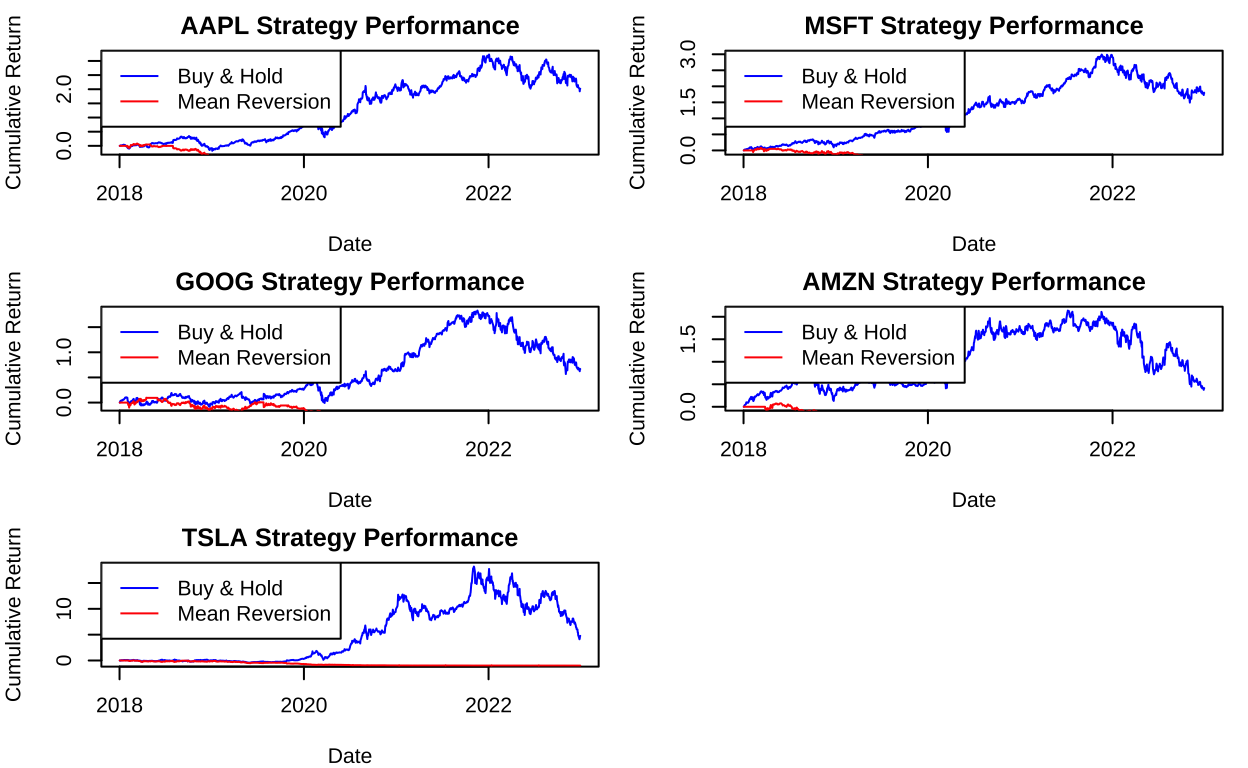

## Symbol Total_Return Sharpe_Ratio Max_Drawdown

## 1 AAPL -0.8533100 -1.1283544 0.8965894

## 2 MSFT -0.6343459 -0.7499161 0.7507296

## 3 GOOG -0.7540258 -0.9509113 0.8259180

## 4 AMZN -0.7442898 -0.8572527 0.8211059

## 5 TSLA -0.9929495 -1.1242993 0.9977061

让我们可视化策略的表现,比较每只股票的策略收益与买入持有收益:

# 创建图表展示每只股票的策略表现

par(mfrow = c(3, 2), mar = c(4, 4, 2, 1))

for (symbol in stock_symbols) {

results <- strategy_results[[symbol]]

# 计算买入持有策略的累积收益

buy_hold_returns <- exp(cumsum(results$Returns)) - 1

# 绘制累积收益对比图

plot(results$Date, buy_hold_returns, type = "l", col = "blue",

main = paste(symbol, "Strategy Performance"),

xlab = "Date", ylab = "Cumulative Return")

lines(results$Date, results$Cumulative_Returns, col = "red")

legend("topleft", legend = c("Buy & Hold", "Mean Reversion"),

col = c("blue", "red"), lty = 1)

}

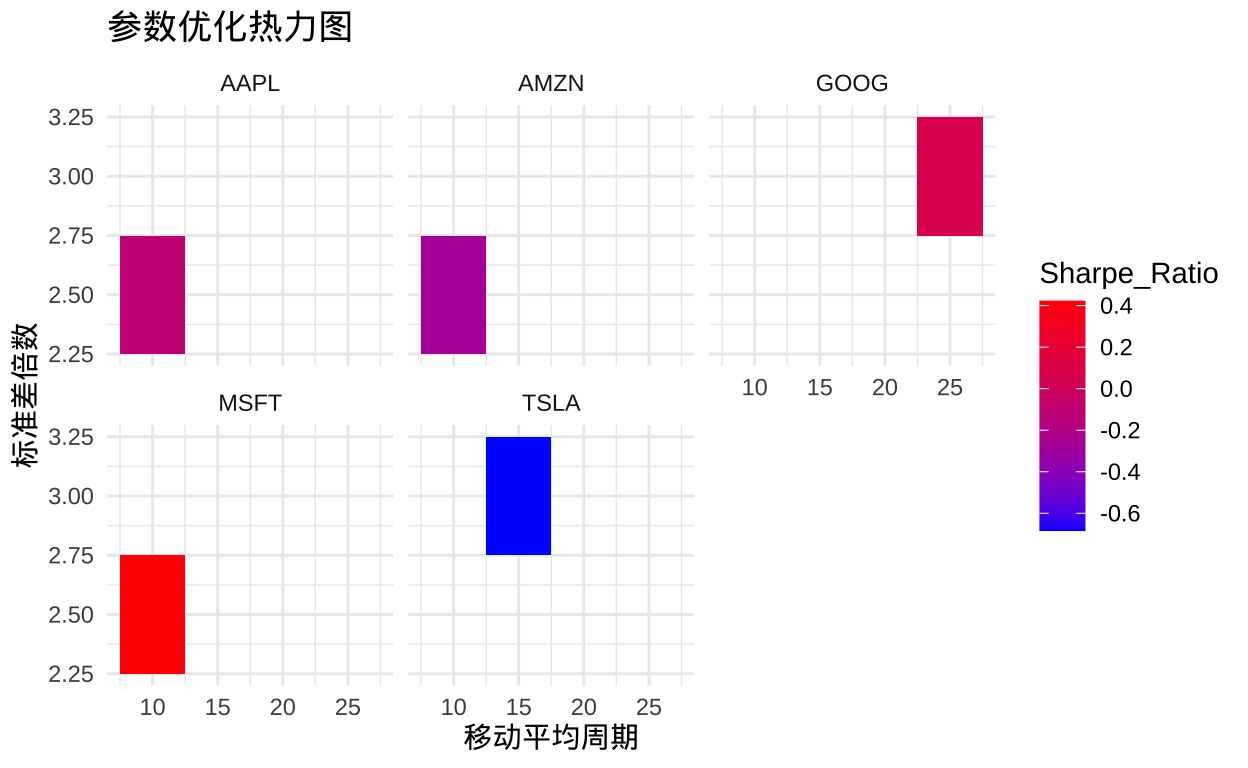

参数优化

接下来,我们将优化均值回归策略的参数。主要优化的参数是移动平均周期和标准差倍数。

我们将使用网格搜索方法来寻找最优参数组合:

# 设置参数网格

ma_periods <- c(5, 10, 15, 20, 25, 30)

sd_multipliers <- c(1, 1.5, 2, 2.5, 3)

# 创建并注册集群

cl <- makeCluster(detectCores() - 1)

registerDoParallel(cl)

required_packages <- c("quantmod", "PerformanceAnalytics", "TTR", "zoo", "dplyr", "tidyr", "xts")

# 对每只股票进行参数优化

optimal_params <- list()

tryCatch({

for (symbol in stock_symbols) {

cat("Optimizing parameters for", symbol, "...\n")

# 使用foreach进行并行计算

results <- foreach(ma = ma_periods, .combine = rbind, .packages = required_packages) %:%

foreach(sd = sd_multipliers, .combine = rbind) %dopar% {

# 应用策略

strategy_result <- mean_reversion_strategy(stock_data[[symbol]],

ma_period = ma,

sd_mult = sd)

# 确保Net_Returns是xts格式

if (!is.xts(strategy_result$Net_Returns)) {

returns_xts <- xts(strategy_result$Net_Returns,

order.by = index(stock_data[[symbol]])[1:length(strategy_result$Net_Returns)])

} else {

returns_xts <- strategy_result$Net_Returns

}

# 计算夏普比率

sharpe <- SharpeRatio.annualized(returns_xts, Rf = 0, scale = 252)

# 返回结果

data.frame(Symbol = symbol,

MA_Period = ma,

SD_Multiplier = sd,

Sharpe_Ratio = as.numeric(sharpe))

}

# 找到最优参数

optimal_params[[symbol]] <- results[which.max(results$Sharpe_Ratio), ]

}

}, finally = {

# 关闭集群

stopCluster(cl)

closeAllConnections()

})

# 输出最优参数

optimal_params_df <- do.call(rbind,optimal_params)

print(optimal_params_df)

## Symbol MA_Period SD_Multiplier Sharpe_Ratio

## AAPL AAPL 10 2.5 -0.10327300

## MSFT MSFT 10 2.5 0.42213306

## GOOG GOOG 25 3.0 0.06798975

## AMZN AMZN 10 2.5 -0.27697175

## TSLA TSLA 15 3.0 -0.68368600

# 可视化结果

if(length(optimal_params) > 0) {

all_results <- do.call(rbind, lapply(optimal_params, function(x) x))

ggplot(all_results, aes(x = MA_Period, y = SD_Multiplier, fill = Sharpe_Ratio)) +

geom_tile() +

scale_fill_gradient(low = "blue", high = "red") +

facet_wrap(~Symbol) +

labs(title = "参数优化热力图", x = "移动平均周期", y = "标准差倍数") +

theme_minimal()

}

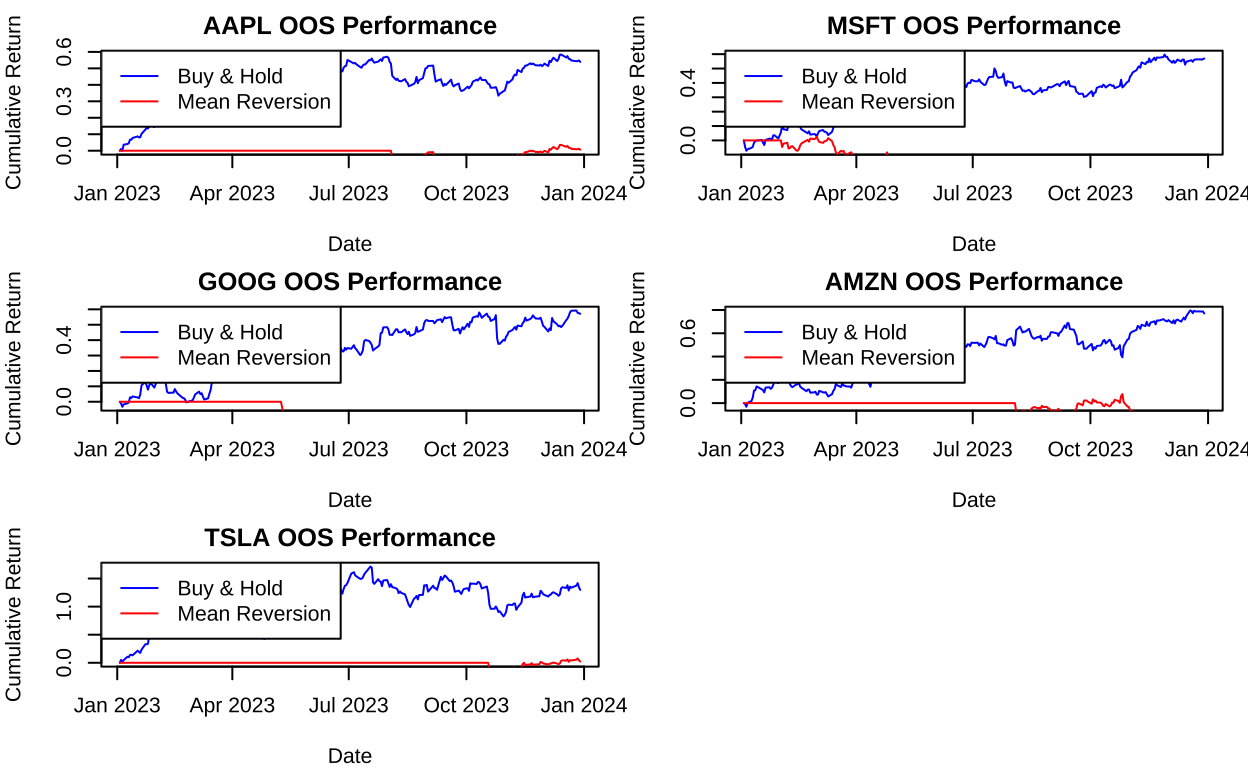

样本外验证

现在我们使用优化后的参数在样本外数据上验证策略的有效性:

# 使用优化后的参数在样本外数据上测试策略

oos_results <- list()

oos_performance <- data.frame(Symbol = character(),

Total_Return = numeric(),

Sharpe_Ratio = numeric(),

Max_Drawdown = numeric(),

stringsAsFactors = FALSE)

for (symbol in stock_symbols) {

best_ma <- optimal_params[[symbol]]$MA_Period

best_sd <- optimal_params[[symbol]]$SD_Multiplier

# 在样本外数据上应用策略

oos_results[[symbol]] <- mean_reversion_strategy(oos_data[[symbol]],

ma_period = best_ma,

sd_mult = best_sd)

# 计算样本外表现

oos_return <- oos_results[[symbol]]$Cumulative_Returns[nrow(oos_results[[symbol]])]

# 确保Net_Returns是xts格式

Net_Returns <- oos_results[[symbol]]$Net_Returns

Net_Returns_xts <- xts(Net_Returns, order.by = oos_results[[symbol]]$Date)

oos_sharpe <- SharpeRatio.annualized(Net_Returns_xts, Rf = 0, scale = 252)

oos_drawdown <- maxDrawdown(Net_Returns_xts)

oos_performance <- rbind(oos_performance,

data.frame(Symbol = symbol,

Total_Return = oos_return,

Sharpe_Ratio = oos_sharpe,

Max_Drawdown = oos_drawdown))

row.names(oos_performance) <- NULL

}

# 展示样本外性能指标

print(oos_performance)

## Symbol Total_Return Sharpe_Ratio Max_Drawdown

## 1 AAPL 0.006107479 -0.016645990 0.1332577

## 2 MSFT -0.328535872 -1.500429504 0.3707137

## 3 GOOG -0.234853317 -1.144584312 0.2632418

## 4 AMZN -0.152420982 -0.851226442 0.2287305

## 5 TSLA 0.022876411 0.003117049 0.1941342

# 可视化样本外表现

par(mfrow = c(3, 2), mar = c(4, 4, 2, 1))

for (symbol in stock_symbols) {

oos_result <- oos_results[[symbol]]

# 计算买入持有策略的累积收益

buy_hold_returns <- exp(cumsum(oos_result$Returns)) - 1

# 绘制累积收益对比图

plot(oos_result$Date, buy_hold_returns, type = "l", col = "blue",

main = paste(symbol, "OOS Performance"),

xlab = "Date", ylab = "Cumulative Return")

lines(oos_result$Date, oos_result$Cumulative_Returns, col = "red")

legend("topleft", legend = c("Buy & Hold", "Mean Reversion"),

col = c("blue", "red"), lty = 1)

}

策略组合与风险分散

最后,我们考虑构建一个包含多只股票的策略组合,以实现风险分散:

# 计算每只股票在最优参数下的日收益率

portfolio_returns <- matrix(0, nrow = nrow(oos_data[[stock_symbols[1]]]), ncol = length(stock_symbols))

colnames(portfolio_returns) <- stock_symbols

for (i in 1:length(stock_symbols)) {

symbol <- stock_symbols[i]

best_ma <- optimal_params[[symbol]]$MA_Period

best_sd <- optimal_params[[symbol]]$SD_Multiplier

# 应用策略获取收益率

result <- mean_reversion_strategy(oos_data[[symbol]], ma_period = best_ma, sd_mult = best_sd)

portfolio_returns[, i] <- result$Net_Returns

}

# 等权重组合

equal_weights <- rep(1/length(stock_symbols), length(stock_symbols))

portfolio_returns_equal <- portfolio_returns %*% equal_weights

# 将组合收益率转换为xts对象

portfolio_returns_equal_xts <- xts(portfolio_returns_equal,

order.by = index(oos_data[[stock_symbols[1]]]))

# 计算组合表现

portfolio_total_return <- exp(sum(portfolio_returns_equal_xts)) - 1

portfolio_sharpe <- SharpeRatio.annualized(portfolio_returns_equal_xts)

portfolio_drawdown <- maxDrawdown(portfolio_returns_equal_xts)

# 展示组合表现

cat("Portfolio Performance (Equal Weighted):\n")

## Portfolio Performance (Equal Weighted):

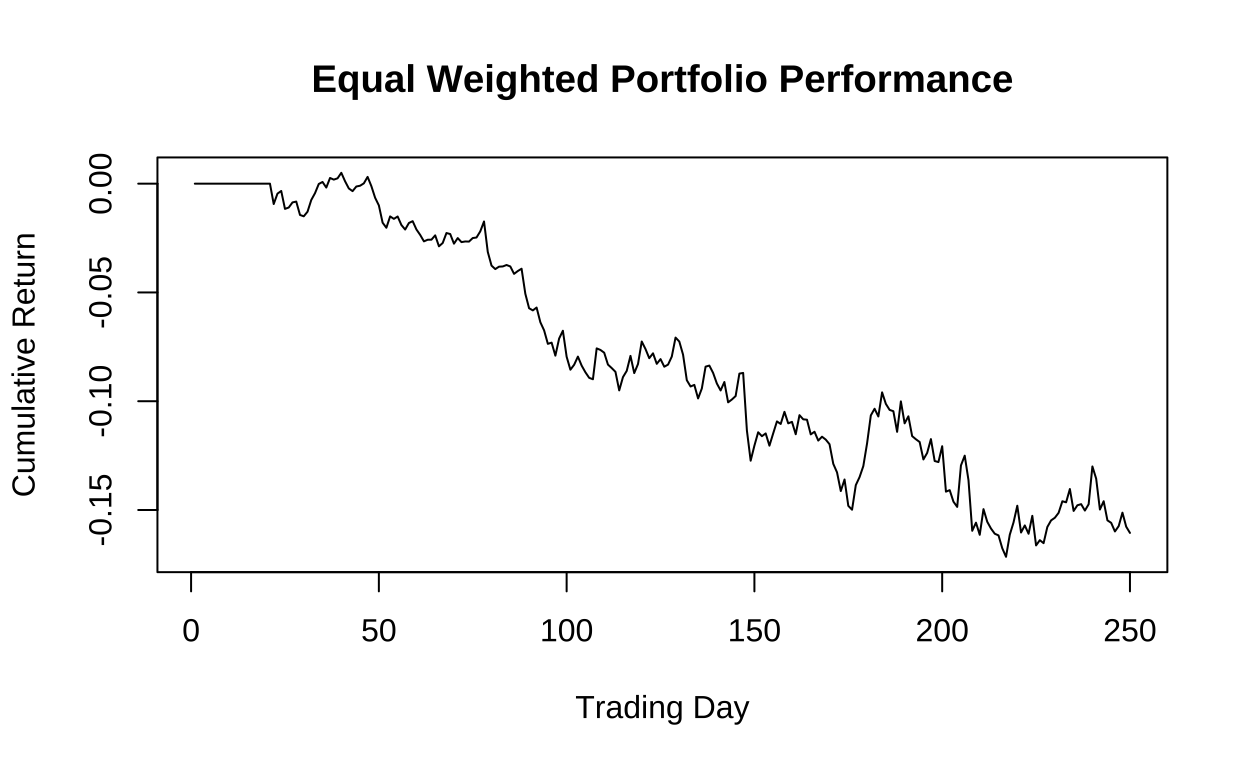

cat("Total Return:", portfolio_total_return, "\n")

## Total Return: -0.1483071

cat("Sharpe Ratio:", portfolio_sharpe, "\n")

## Sharpe Ratio: -1.58031

cat("Max Drawdown:", portfolio_drawdown, "\n")

## Max Drawdown: 0.1649416

# 可视化组合表现

plot(cumsum(portfolio_returns_equal), type = "l",

main = "Equal Weighted Portfolio Performance",

xlab = "Trading Day", ylab = "Cumulative Return")

结论

本文通过R语言实现了基于布林带的均值回归策略,并在多只股票上进行了测试。主要发现如 下:

均值回归策略在某些股票上表现良好,但在其他股票上可能表现不佳,表明该策略的有效 性依赖于股票的特性。

通过参数优化,我们能够找到每只股票的最优参数组合,显著提高策略的表现。

样本外验证表明,优化后的策略在新数据上仍具有一定的有效性,但性能通常会有所下降, 这反映了过拟合的风险。

通过构建多股票组合,我们可以实现风险分散,降低单一股票波动对整体策略的影响。

总体而言,均值回归策略是一种可行的交易方法,但需要谨慎选择适用的股票,并进行适当 的参数优化和风险控制。在实际应用中,还应考虑市场环境的变化,因为均值回归策略在趋 势市场中可能表现不佳。

未来的研究可以考虑结合其他技术指标来改进策略,或者探索不同的均值回归方法,如基于 价格与移动平均线的偏离度等。